Platforms have gone from being optional to 'pivotal' for the profession, planners have told Financial Planner magazine for our latest quarterly survey.

Planners say they make it faster and easier for them to manage clients' complex portfolios and manage their own businesses.

But while many planners have embraced platforms as central to their practices and are increasingly using them to drive business efficiency many say there remains room for improvement. Platforms need further polishing with some planners calling for improvements in tools, reporting and data standards, all of these enhancements on the wishlists for planners.

{desktop}{/desktop}{mobile}{/mobile}

Planners and Paraplanners have explained how using platforms is increasing their business efficiency as they offered their expert insight and tips.

Former IFP president Ian Shipway FIFP CFPCM was clear on the advantages of platforms for his firm HC Wealth Management.

He said: "The key benefit in using a platform to hold custody of client assets is the efficiency it offers over holding discrete investments in silo product wrappers.

"This efficiency provides significant client and adviser benefit in more reliably capturing asset class returns, achieved by avoiding the necessity to be out of the market during rebalancing or wrapper switching exercises.

"A second key benefit is the control of costs through bulk buying deals, electronic trading, commodity priced wrappers and reduced administrative burdens."

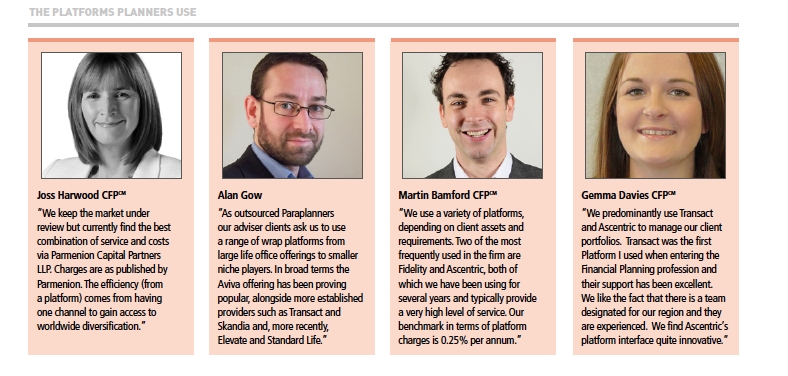

Gemma Davies CFPCM of Uniq Family Wealth described platform technology as "pivotal to the delivery of advice for our clients".

{desktop}{/desktop}{mobile}{/mobile}

She said: "It is widely accepted that their use enhances efficiency and this has ensured that we spend more face to face time with our clients but we know that information can be accessed quickly at the click of a button. It also allows us to implement any necessary changes to our portfolios quickly, to our clients benefit."

But she advised others to make use of any available training resources from the providers – whether face to face or remotely – as it can "save countless hours in navigation".

Paraplanner John Redmond, of BPH Wealth Management, said: "Ultimately the use of a platform is something to make our lives easier and improve outcomes for clients.

"Administering investments (reporting, rebalancing, tax management) on a platform saves a huge amount of time which can then be devoted to financial planning."

Paraplanner Alan Gow, of Argoanut Paraplanning, said most of his adviser clients use wrap platforms for their investment business.

He said: "This drives business efficiencies, in particular where adviser firms are using CIPs / model portfolios where rebalancing can be done at the click of a mouse.

"However the use of such wrap platforms must not just be to the benefit of the adviser firm; these efficiencies should also allow them to reduce the costs to their client.

"Other benefits to the client include consolidated investment reporting, available online, viewed at their convenience, with less paperwork and, perhaps most importantly, the opportunity to benefit from an appropriate investment strategy across all wrappers, meaning holdings can be more meaningfully assessed and managed."

However, he warned: "They are certainly not a 'one size fits all' solution and advisers need to be mindful of the benefits to the client first and foremost."

{desktop}{/desktop}{mobile}{/mobile}

Joss Harwood CFPCM, of Eldon Financial Planning, said: "The efficiency comes from having one channel to gain access to worldwide diversification with a relationship that means we can be confident that we can deliver our promsies to our clients in a clear and transparent way."

She had this advice for other planners: "Make sure you are using wrappers for the 'right' reason which is to optimise each client outcome; not because using a platform makes life 'easier' for the firm."

Martin Bamford, CFPCM says his firm Informed Choice uses Avelo Adviser Office, to aggregate data from various platforms and present this to clients.

He said: "Using platforms makes it much faster and cheaper to carry out basic tasks, including fund switches and withdrawals.

"This often means the work has been passed down the chain, from provider to adviser, but this is a small price to pay when it places us in control of the workflow and means the job can be completed faster, and to a higher standard.

{desktop}{/desktop}{mobile}{/mobile}

"Data is easier to store and interrogate, so it can be presented in a client friendly fashion and in a way which is consistent for clients despite coming from multiple sources."

Looking at some of the disadvantages however, Ms Harwood points out that "One downside is external - the unrelenting suspicion from the regulator that we must somehow be disadvantaging clients if they don't all get something different."

A disadvantage identified by Ms Davies was some clients being unused to dealing with platforms and therefore feeling "bombarded with paperwork" – though one of her firm's platform providers allows most correspondence to be sent electronically.

Mr Gow said some platforms need to improve their tools and reporting and others need to improve their customer service.

He would like to see further reductions in charges to allow lower net worth clients to benefit from the wrap features, particularly Isa investors.

Martin Bamford said it would be good to see more consistency around data standards and reporting to recognise that advisers would prefer to use back office systems to aggregate and then present information to clients.

He said: "We would also like to see clients get the same reporting and functionality as advisers when using platforms."

Mr Redmond would like to see better interaction on in-specie transfers. Mr Shipway said firms must consider that a platform is an administrative tool and not a discrete product.

He said: "It cannot therefore be set up and forgotten but needs constant attention. In order to get most benefit from the advantages of using a platform advisory firms need to ensure that they develop procedures that ensure on ongoing management and review of the client's account."

He also had this tip: "The greatest efficiencies will be gained by limiting the number in use to ensure the operating procedures for the support team and advisers can be optimised."

{desktop}{/desktop}{mobile}{/mobile}

Gillian Hepburn of Quality Platform Solutions offers her tips when dealing with platforms:

If one of the key benefits of platforms is to help advisersdrive efficiency then the key process challenges are often around trading, dealing and rebalancing.

The move to outsourced investment solutions such as model portfolios may introduce a consistency in investment process but the use of a range of investment types required e.g. collectives, ETFs and Investment trusts is often unworkable and expensive in terms of dealing costs.

An adviser was complaining recently that the provider's solution was to invest regular contribution in cash until a point where they could be moved to the model to minimise dealing costs.

There is no 'silver bullet' to avoid being disappointed but perhaps the following might help:

1. Identify your priority business processes and walk through them with the platform provider identifying responsibility for each step. Ensure you understand when a process step is being completed manually as human intervention often increases risk of error. Compare these with your existing processes and understand to what extent you have to adapt them. Question yourself - does this platform really add value?

2. Make sure the platform provider really understands your business model and the expectations you have – agree service levels for key business processes and ensure they are monitored.

3. If looking for a new platform, ask for reference sites and contact/meet them – involve key staff such as Paraplanners and administrators in this process. They are more likely to be using the platform on a daily basis and have a good understanding of the status quo.

4. Understand the level of service support will your business get and how is this accessed e.g. online, telephone based or face to face and is it sufficient?

Define what good service means to you and stick to your requirements.

{desktop}{/desktop}{mobile}{/mobile}

David Cartwright – head of insight and consulting of wealth and protection at Defaqto - offers his insight

As a major research house we see platform trends probably more close up than many bodies in the market - and we are in the privileged position of working with all the parties connected to platforms including Financial Planners, Paraplanners, investment houses, the platform operators themselves and the other associated parties including Sipp operators, DFMs and wealth managers.

Regarding business efficiencies and giving clients a better service, the dynamic here seems to have changed with many planners and Paraplanners having now clarified the division of labour between the requirements from the chosen platforms and the tools and functionality afforded by the chosen back office employed within the business. This particular fact is borne out and supported by our own management information from our Engage research software used by several thousand advisers, which clearly indicates that more fundamental criteria is driving selection, such as charging models and interest on cash accounts.

Up to 16 platforms are regularly being researched with the top 10 comprising a balance of more open architecture wrap models and the more commoditised collective investment structures.

The trend to more investment outsourcing, at least for certain client segments has meant that access in the fund world is more focused upon the multi-asset solutions whilst access to the DFM outsourced Managed Portfolios has proven more of a challenge as elements of this market utilise asset types not always available on many platforms—an interesting market to observe looking forwards as we have already seen a polarisation of the DFM Managed Portfolio market between those that are designed as platform linked propositions, relying upon certain elements of platform functionality, and those which are more direct models not relying upon a platform.

Finally, while platforms certainly take centre stage for key elements of any planning firms proposition, there still remains a significant minority of advice and investments being made off platform typically to address execution of more specialist products and solutions, structured and guaranteed plans and indeed where various tax wrappers are used, particularly for more moderate clients where the whole basis point assessment comes in to play relating to total cost.