The value of the state pension, in terms of comparison with national average earnings, has been in decline for many years and this is likely to continue. The public are realising that the state may no longer provide the level of retirement income that they desire.

Against this backdrop, auto-enrolment makes sense for the millions who want a better retirement but what role do Financial Planners play in the development of auto-enrolment, the workplace pension the government has placed much emphasis on?

Many have dismissed the role of financial advisers when it comes to auto-enrolment, believing that larger employee benefits firms will command the market, but in this thought- provoking article Andrew James of Towry believes that auto-enrolment and the NEST scheme can be invaluable for Financial Planners looking to develop their business in the area of pensions advice. He discusses the ways auto-enrolment can unlock new opportunities with clients of all types.

The level of state pension has been reducing over many years and although in recent times we have seen guarantees put in place to help maintain future values, the effect of lower increases in the past mean that these pensions are often unlikely to provide more than a basic income.

Certainly, anyone thinking that the state will provide them with what they need in their later life is likely to be in for a rude awakening and more than likely to be taking the generous opportunity provided by the Government's removal of the default retirement age to work well beyond normal retirement age. So with all that in mind, the Government – in its many guises over the years – has been looking at ways to encourage retirement savings and eventually came up with auto-enrolment.

As a reminder, legislation requires all employers to enrol their eligible employees into a qualifying pension scheme. Anyone aged over 22 and under state pension age and earning at least the minimum amount per annum (currently set to align to the 2012/13 personal allowance threshold of £8,105) will be an eligible employee.

A qualifying pension scheme can be one specifically set up by the employer via a third party provider, or by the national scheme run by the National Employment Savings Trust (NEST).

The enrolment process will be phased in over a period of years based on the size of the employers' workforce. The country's largest employers will already be in the throes of enrolling their employees and the whole process (down to employers with only one employee) is due to be completed by April 2017. The table below shows staging dates.

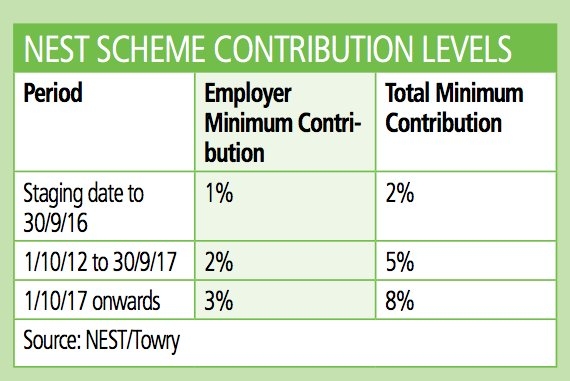

The contribution levels by employer and employee must meet certain criteria to qualify. If contributions are paid to NEST, these payments will be increased over a few years and will eventually reach 3 per cent from the employer, 4 per cent from the employee and 1 per cent from the Government, via the tax relief received on the employee's contribution – thus a total of 8 per cent. Depending on how contributions are calculated via an employer's own scheme they may vary slightly on the above percentages and will also be phased in over the same period.

{desktop}{/desktop}{mobile}{/mobile}

The final outcome from October 2017 will be as follows:

a total minimum contribution must be at least 9 per cent of the scheme's definition of pensionable pay (at least 4 per cent of which must be the employer's contribution), or a total minimum contribution must be at least 8 per cent of the scheme's definition of pensionable pay (at least 3 per cent of which must be the employer's contribution) provided that pensionable pay constitutes at least 85 per cent of total pay (the ratio of pensionable pay to total pay can be calculated as an average at scheme level); or a total minimum contribution must be at least 7 per cent of the pension scheme's definition of pensionable pay (at least 3 per cent of which must be the employer's contribution), provided that total pay is pensionable.

If the scheme is a defined benefit arrangement different qualifying rules apply which mainly require an accrual rate of at least 1/120th of qualifying earnings. The vast majority of employees will be enrolled into a money purchase arrangement where their own contributions will be combined with their employers and the tax relief and invested into one or more funds. Each scheme will have a default fund where the contributions go if no election is made by the employee. The intention is that this fund will be suitable for the majority of employees. However, that does not mean that it will be right for all. This leaves two opportunities. Firstly, to advise the employer on the best scheme to chose and which default fund would be suitable based on their workforce, and secondly to potentially offer retirement advice to employees.

Taking the employer proposition first, I believe that there is a real need to give advice and that fee opportunities are available. In many cases one scheme may not be the answer. NEST or one of the other 'vanilla' offerings may well be suitable for the general workforce but a more bespoke scheme could be the answer for more senior employees where fund choice and more in-depth retirement planning is likely to be required.

The situation, as far as advising employees stands, will very much depend on the workforce. It is unlikely that those unused to investing will see any great benefit in receiving advice and unless this advice is to be sponsored by the employer it is unlikely to be cost effective to provide. In most cases the default fund choice will be reasonably suitable for all.

However, for those needing or able to take higher risks, as they have plenty of time to invest before they retire, and those at the other end of their working lives who probably should be taking little risk, this does cause concern.

If the employer can be persuaded that covering the cost of advice to senior employees makes sense as part of their package then a good business model can be produced ensuring that these individuals are properly advised. This will be particularly important when reviewing retirement plans for high earners where they already have significant pension benefits. There will be individuals who have previously applied for the various forms of pension protection that have been available following changes in pension legislation.

{desktop}{/desktop}{mobile}{/mobile}

Primary protection offered the individual an increased personal lifetime allowance to take account of their pension savings already in excess of the previous £1.5 million allowance and allowed further pension contributions to be made, albeit that any pension savings in excess of their higher personal lifetime allowance will be taxed at 55 per cent if taken as a lump sum or 25 per cent if taken as taxable income. Care should therefore be taken to understand the tax efficiency of any future contributions paid under auto enrolment to ensure that gaining tax relief on the contributions does not simply lead to an unexpected tax charge when the benefits are taken.

Enhanced protection offered full protection against any lifetime allowance tax charge but required the individual to cease any further pension accrual after April 2006 which basically meant that all pension payments must stop as well as any benefits based on increasing service from a new final salary scheme (some limited accrual is permitted for those in a final salary scheme at 5 April 2006 and continue to remain in that particular scheme). The consequence for someone with this type of protection being auto-enrolled by their employer could be very significant. Potentially a massive tax bill for what could be a very small pension contribution.

A similar position arises with the latest form of protection - fixed protection, as the consequences of further pension accrual as a result of auto- enrolment would be to reduce the individual's lifetime allowance from £1.8m to £1.5m with a potential tax charge of up to £165,000.

Opting out may be the best advice for those with pension protection. However, the first problem is that the legislation requires that an employee must not be asked to sign any documentation to be auto-enrolled. So potentially the first an individual will know about being in a scheme will be a notification from the employer that they have been enrolled.

It will be necessary to complete an opt-out form and forward it to the employer within a month of being enrolled. This will need to be obtained from the pension scheme as the employer is not allowed to provide these. This rule was put in place to guard against the employer influencing any opt-out decision. Any failure to complete the opt-out within the required timescales means not receiving a refund and benefits will therefore have accrued with the consequential loss of any enhanced or fixed protection. Getting to the right people at an early stage is vital.

Take care even if you think your client is not an 'employee.' For example , a non-executive director (who would normally be considered an 'office holder' rather than 'employee'), may be classed as being an 'employee' in respect of part of their duties and so could still be eligible for enrolment. I would therefore strongly recommend that anyone in this type of position checks with their employer as to how their post is viewed to ensure everything is correct.

As a final consideration, even if your client is not affected with any forms of protection, don't forget that the annual allowance limits pension contributions to £50,000 each tax year.

If they are already fully utilising the annual allowance then make sure you take account of any likelihood that they will be auto-enrolled at some stage in the tax year and ensure that you do not allow them to over contribute.

You should also make sure that any new contributions are not likely to cause their total pension savings to exceed the latest £1.25m lifetime allowance, or at least if they do, that you are comfortable that the benefits from these new contributions outweigh the tax consequences.

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.