In a world of often disappointing investments, many ETFs and other Exchange Traded Products (ETPs) have been a "decade- long success story in Europe," acccording to Morningstar data.

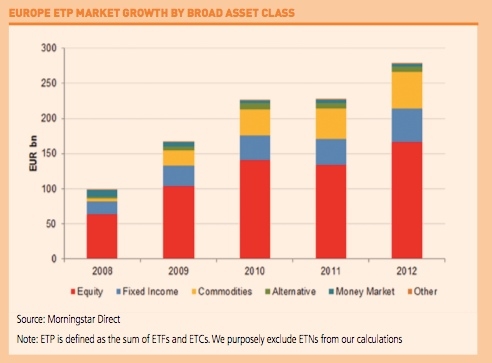

In Europe ETP assets grew by an impressive 22 per cent last year to reach €278bn. This figure was boosted by a combination of net inflows and capital appreciation. Despite this Europe represents only 20 per cent of the global Exchange Traded Product market worldwide although it's worth noting that the European market has almost tripled in size over the last five years.

The question now is where next for ETFs? Morningstar ETP experts Hortense Bioy and Jose Garcia Zarate explore the growth of the market and look at the potential in the retail market. ETFs have been taken up by institutions but retail investors have been slower. Will this change or are there factors holding back ETFs in the retail market.

Up to now the development of ETPs in Europe has been driven by demand from institutional clients. This has been a key differentiating factor with the US where ETP take-up by retail investors is at par with that of institutions. However, change could be in the air for Europe; and the UK leads the way.

The implementation of the RDR in 2013 will create more of a level playing field for the distribution of both active and passive investment propositions to private clients. As such, it becomes important for these clients and for the professionals who advise them to be cognisant of ETP realities.

The goal for most ETP providers is to offer investors integral solutions to build portfolios. This implies availability of funds to gain exposure to all asset classes and catering for both strategic and tactical investment needs. There is certainly no shortage of ETPs in the European marketplace to fulfil such goal. Although the ETP space remains dominated by equity exposure, over the last five years we have seen important progress in terms of product development in the areas of fixed income and commodities. It would be fair to say that nowadays it is perfectly possible for any European investor to build a comprehensive investment portfolio made up solely of ETPs.

While as of today very few retail investors hold portfolios consisting exclusively of ETPs, we are seeing a clear move towards greater use of passive instruments. Investors, together with their financial advisers, are embracing the idea that some of their money should be invested passively as they realise that only a minority of active managers are able to consistently beat their benchmarks. At the same time, a growing number of investors are becoming aware of the numerous advantages that ETPs offer over traditional actively-managed mutual funds. Chief among them is their low expense ratios. ETPs offer low cost access to a multitude of asset classes and sub-asset classes which used to be available only to institutional investors and high-net worth individuals.

One of the questions that we at Morningstar often hear from financial advisers is: what is the ideal amount of ETFs and other ETPs I should be using in my clients' portfolios? The honest, but probably thankless answer can only be "it depends on your clients' goals and risk profile". However, we follow this by providing guidance as to how they can use these innovative instruments within a portfolio.

{desktop}{/desktop}{mobile}{/mobile}

Using ETPs as asset allocation tools

First things first. We always remind financial professionals and investors that before thinking about what type of investment vehicles they should be using, they need to figure out the right asset allocation to meet their investment goals. Having the right mix of stocks, bonds, cash and commodities - and being well diversified within each of these asset classes - can have a significant impact on returns. By virtue of being low cost, transparent and flexible, ETPs can help you achieve that.

When it comes to building portfolios, many financial professionals and investors use the core- satellite approach. And with good reason, as this approach allows for efficient control of risk-return targets. It is also fairly straightforward and can be easily executed using ETPs.

The core portfolio, which forms the foundation of the strategy, can be typically made up of broad index ETPs. By offering exposure to a wide variety of broad equity, fixed income and commodity benchmarks, these ETPs will deliver exactly what they promise: a return in line with the market's performance –often referred to as the beta return. And they will do it at much lower cost than any actively-managed mutual fund.

Supplementing the core portfolio, the satellites typically consist of more specialised investments. Those represent short-term tactical calls or "tilts", and they generally carry higher risk and fees than core investments. Their aim is to deliver extra return – often referred to as alpha return. This alpha return is often achieved through exposure to actively managed funds and individual securities. But ETPs can play that role just as well. The trading flexibility and granularity of ETPs allow you to pick any particular segment of the market and underweight or overweight it depending on the investment view you seek to express.

Specifically, tactical strategies can take the form of sector bets. In fact, the ETFs that track the STOXX 600 sector indices have become some of the most popular ways to place sector bets and implement sector rotation in Europe. Regional or country level bets are another option. If you believe, for example, that Brazil has the strongest short to medium-term economic prospects among all the BRIC countries, you could express this view by allocating some money to one of the Brazil ETFs currently on offer.

Factor exposure, be it value, size, or increasing perhaps momentum, is another increasing popular topic within the ETF marketplace. For instance, if you think the macroeconomic environment looks favourable to small-caps, you can choose to overweight a portfolio's equity exposure to that particular corner of the market. There are plenty of ETFs offered by iShares, db X-trackers, Lyxor, SPDR, Source and UBS giving access to US, Europe, Japan and emerging markets' small caps.

ETFs are also suitable for cash equitisation purposes. They are great tools for managing cash flows while reducing cash drag; effectively offering beta exposure between the time a client's account is fully funded and the time portfolio investment decisions are ultimately made and implemented.

Beyond the topic of portfolio completion, ETPs can also be used to manage a whole host of different risks that may exist within an investment portfolio, such as duration, credit or currency. For instance, there is a variety of maturity bracketed fixed income tracking ETFs that can be deployed actively to increase or decrease duration (i.e. the sensitivity of the portfolio to changes in interest rates) within an existing bond allocation.

{desktop}{/desktop}{mobile}{/mobile}

The list of potential uses for ETPs within a portfolio is long and emphasises their versatility. But irrespective of the intended use, before placing money in an ETP it is very important to look under the hood of the product and conduct proper analysis of the underlying index. It is not just a case of making sure one understands that the returns of the ETP will ultimately be a function of the returns of the index, but to make sure that the index gives you the exposure you are actually seeking to rightly express your investment goal.

This may be particularly relevant when seeking exposure to emerging equity markets, whether on a broad or single-country geographical basis, as the indices that provide such exposure tend to be heavily biased towards one or two sectors. Going back to the earlier example on Brazil; more than a third of the commonly used MSCI Brazil index is made up of raw materials and energy companies, whose share price is probably driven more by international commodity prices than the health of the Brazilian domestic economy.

A few pointers for 2013

Investing using ETPs essentially means investing in a macroeconomic view. The term "passive investment" can be misleading. You may not have to cherry pick individual securities but you still have to carefully weigh up the exposure to the array of asset classes. In short, using passive funds does not turn you into a passive investor. The latest money flows trends in the European

- and global – ETP market talk of a re-allocation of investment away from the perceived "safe-havens" and into riskier asset classes, with global ultra-loose monetary policy settings acting as something of an insurance policy. Of course the global economy outlook is still subject to a considerable degree of downside risks but investors' confidence seems to have improved. Already in the last quarter of 2012 we saw a bit of rush into equity ETFs, which has seen a continuation in the early stages of 2013. Morningstar data shows that European investors have started to transition into equities by choosing ETFs tracking indices with a broad geographical exposure (e.g. Europe and/or emerging markets as opposed to individual countries). This could be interpreted as a classic early sign of asset rotation, with investors showing a degree of caution – or hedging – by avoiding discrimination, either in terms of geography or economic sector. Any decrease in downside risks to the global economic picture as the year progresses should probably prompt investors to become more daring in their choices. But even at this juncture it is probably fair to say that both the US, and particularly so emerging markets, will continue to outperform the developed European economies.

When it comes to fixed income; the Euro sovereign debt situation still poses some risks, but perceptions have radically shifted. It is no longer a case of "the Euro is about to collapse" but more of "the Euro is here to stay at all costs". This has already had interesting implications for the internal dynamics of the Eurozone government bond market and by extension for the UK gilt market.

In any case, the bulk of product development in fixed income ETFs in the years ahead is likely to focus on corporate debt - both investment-grade and high yield - and emerging markets, to befit investors' increasing interest for these segments of the fixed income universe. This is a clear example of how ETFs are breaking down the traditional access barriers to fixed income markets, allowing individual investors to gain exposure to areas that traditionally had been the preserve of institutional clients.

With this article we have tried to highlight how ETPs bring a whole array of benefits to improve investment planning. Institutional investors are already enjoying these benefits. Perhaps time has come for others to start enjoying them too.

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.