The passive fund industry has grown strongly over the last decade or so as investors have increasingly sought out lower-cost solutions and, in the case of the UK, due to the Retail Distribution Review.

This growth has been particularly strong on the exchange traded side and shows no signs of slowing. But what opportunities do passive funds offer Financial Planners and their high net worth / mass affluent clients and are there some less heralded advantages that have gone under the radar.

Patrick Norwood, a Chartered Financial Analyst at Defaqto, addresses these questions, as he explores the most important aspects of passive investing. He also examines how the market has changed in the last few years and how he foresees it evolving in the short to medium term?

Mr Norwood takes a look at the key differences between active and passive investing, along with the advantages and disadvantages of each within a portfolio.

He explains how he assesses different types of passive funds, either exchange traded or more traditional OEIC/unit trust structures and looks at other key issues surrounding passive funds.

Actively seeking out the opportunities passive funds offer Financial Planners and their high net worth clients

The opportunities passive funds offer Financial Planners and their high net worth / mass affluent clients are firstly, a very low risk of underperforming the benchmark, and secondly, generally lower fees.

There is another, possibly less discussed, advantage of passive investing. Financial Planners will often provide future projections for their clients, for example, how large a portfolio might be at some point in the future if the client invests a certain regular amount of money per month into it. The models for these projections will use forecasts for the market, or index, returns and volatility of the asset classes invested in.

Therefore, passive funds will have the same (or virtually the same) risk-return characteristics as those in the models producing the projections, while active funds will have, to varying degrees, different risk-reward characteristics from those of the model.

Thus using passive funds enables a planner to stay closer to the projections of their asset allocation or risk tool. As I will show, the passive fund industry has grown strongly over the last decade or so as investors have increasingly sought out lower-cost solutions and, in the case of the UK, due to the Retail Distribution Review. This growth has been particularly strong on the exchange traded side and shows no signs of slowing.

The main disadvantage of passive investing that Financial Planners need to be aware of is that the investor will forgo potential outperformance over the benchmark, also known as ‘alpha’.

In these times of lower investment returns, a few extra per cent of return each year can make a significant difference over time.

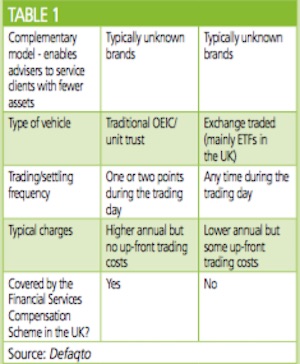

Table 1 shows the two different kinds of passive investment along with the advantages and disadvantages of each.

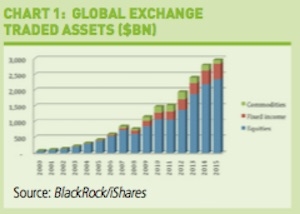

As can be seen from Chart 1 below, after 15 years of almost uninterrupted growth, global exchange traded assets, at the end of 2015, stood at nearly $3tn. As the chart shows, the majority of these assets are in equities.

Just over half of the equity total is composed of US equities. Within commodities, half the assets under management (AUM) relate to gold. Turning now to open ended passive funds, the following charts show recent numbers for UK domiciled funds, both in terms of AUM and industry share. As can be seen, there has also been growth in this area, with the passive open ended fund share of total UK funds now standing at more than 12.4 per cent, compared to 6.6 per cent 10 years ago.

In parallel, the last few years have seen a big shift away from synthetic to full and partial replication, at least in the UK. This is most likely due to the fear by many planners of the counterparty risk associated with the synthetic method.

How do we at Defaqto assess and rate passive funds? Firstly we split the universe by asset class and whether the fund is an ETF or an OEIC/unit trust, so that we are comparing like with like when rating each fund.

Within each of these sub-universes the funds are ranked and scored on the following:

• Ability to track, that is how well the fund has met its objective – we use ‘r-squared’, which measures the correlation between the returns of the fund and its respective index, over both 1- and 3-year periods

• Ongoing charges

number of distribution partners (OEICs and

• Unit trusts only) – a key plus for any fund is being available through many platforms

• Fund size – it is generally accepted that most funds are not particularly profitable or comfortably sustainable until they reach a certain size

• Group AUM – gives an indication of scale and resources

• Return on any stock lending for funds that hold physical securities

• Counterparty risk for funds that engage in synthetic replication

• UCITS compliance and domicile – a key plus for any fund today is having UCITS status, because it gives investors some assurance that certain regulatory and investor protection requirements have been met

These are added up to give an overall Diamond Rating, with 5 indicating the best quintile in that market and 1 the worst. When totalling the individual scores, the above factors are weighted such that they have the following effects on the Diamond Rating:

Risk includes counterparty risk, UCITS compliance and domicile. Accessibility is repre- sented by number of distribution partners.

We always keep an eye on market develop- ments and regulatory influences and may sometimes update our rating criteria in order to remain up-to-date. The following numbers and trends within the data used for our 2016 Diamond Ratings may be of interest to Financial Planners. Firstly, passive investments’ ability to track is now generally very good, especially in the case of ETFs.

The average r-squared is around 95 per cent for the traditional passive funds covered by us and more than 99 per cent for the ETFs in our universe (a number of 100 per cent would indicate perfect tracking of the index). In the case of open ended, the one sector where we have seen several funds failing to track their index is non-UK Fixed Income.

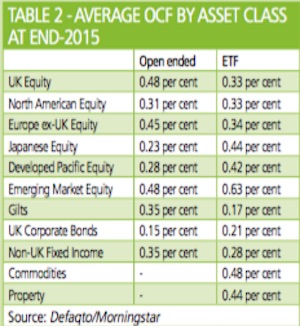

The other numbers, which might be of interest to planners, are the latest passive ongoing charges by asset class.

The ETF figures are what might be expected by most people: equity ETFs have higher charges then fixed income ones; within equities the developed market ETFs have similar charges to each other and lower than those of emerging markets; and within fixed income, gilt ETFs have lower charges than corporate bond ones and UK bond ETFs cost less than non-UK ones.

The numbers for traditional passive funds, however, are maybe less expected: more variation among the developed equity market sectors; UK equity funds costing the same as Emerging Market ones on average; and passive gilt funds appearing very expensive in relation to the other asset classes. One reason for this is more outliers in terms of charges within open ended passive funds.

Financial Planners can of course include both active and passive investments in a client’s portfolio. Many people believe that some markets, such as US equities, are very efficient and already highly researched by fund managers and analysts. Therefore, passive management might be best for that part of a portfolio, as it is harder for a manager to add any further value. Emerging markets, however, are less efficient and researched, offering more scope for active management in that area.

Other studies, though, have shown that high proportions of active managers of less ‘efficient’ asset classes have underperformed their benchmark, with there being a greater percentage of underperforming managers than for the more efficient classes.

The less efficient classes will generally have higher fees than the more efficient ones. For example, emerging market equity funds will often be more expensive than US or UK equity funds on average, while high yield bond funds normally cost more than investment-grade bond funds. Therefore, on a gross basis, the manager of the less efficient and more expensive asset class starts ‘further behind’ the index, which means that they will have to beat the index by a greater amount just to break even.

Whichever of the above competing thoughts one believes in, there may be occasions when it makes sense for planners to design portfolios holding both active and passive within the same asset class. When using active managers, investors face a relatively wide distribution of returns. When combining an active fund with a passive fund for that asset class, however, then the distribution of potential returns will be dampened – there will be fewer very low return outcomes, but also fewer outcomes of very high returns.

This reduction in the distribution of returns should reduce ‘client risk’ – the chance of clients leaving if their returns fall below a certain level. In summary, the advantages of passive investing include lower costs on average, virtually no manager risk (the ability of passive funds to track their respective index is generally now very good) and enabling a Financial Planner to stay closer to the projections of their asset allocation or risk tool; while the main advantage of active investing is the potential ability to achieve outperformance over the benchmark.

Passive investments don’t always have to replace their active equivalents though – indeed, it is often sensible for portfolios to contain both active and passive investments.

Within passive, funds can have either exchange traded or more traditional open-ended structures and invest via full, part or synthetic replication. The choice of active versus passive, fund structure and investment method will depend on issues such as:

• The planner’s belief as to whether or not good active managers exist for that asset class

• The client’s attitude to cost

whether intra-day liquidity is important whether the planner and client can tolerate

• The counterparty risk associated with synthetic investments

Among the different passive peer groups there have often been variations in charges and other fund attributes, therefore initial due diligence and ongoing review are very important. Defaqto’s Diamond Ratings can act as a framework for research into passive funds, comparing and rating them across a range of criteria and allowing Financial Planners – and their clients – to see where they sit in the market in terms of quality.