He says the questions are: 1. Will the Eurozone crisis be resolved in a timely and effective manner? 2. Will the US economy maintain its recent better performance? 3. Will the Chinese economy avoid a hard landing in 2012?

The answers to these questions are not all favourable, be believes. The outcome of the Eurozone debt crisis remains very unclear, he warns, even after the Brussels summit of December 8-9, implying that the crisis is likely to continue and possibly even rise to another crescendo during 2012.

He says in the US the improvement in performance has been only partial – limited to certain sectors of the economy – and while some of these improvements should be sustained, the overall economy is likely to be held back in 2012 by many of the same headwinds that eroded performance in 2011.

He adds that, the Chinese economy remains excessively dependent on external demand and hence acutely vulnerable to the deepening downturn in Europe. Thus even though domestic monetary and fiscal stimulus will almost certainly be employed in 2012, China's overall growth rate seems likely to be lower than in 2010 or early 2011, he forecasts.

He said: "In the developed world the normal recovery process after a recession has not materialised during the three years since the Lehman bankruptcy. The reason, of course, is the overindebted or impaired state of balance sheets, particularly in the household and financial sectors. This means that large parts of the developed economies must focus on debt repayment by restraining consumption and postponing new investment, leading to sub-par economic growth.

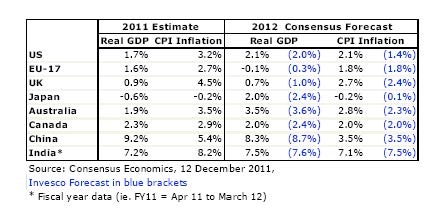

"In response, governments initially stepped up their fiscal support programmes, but since debt levels were already high, the additional burden of official sector debt has now triggered a sovereign debt crisis across much of Europe and threatens to do so even in the US and the UK if deficit spending is not curtailed. This implies that 2012 will be another year of balance sheet repair by the private sector, austerity by governments, and slow growth in most of the advanced economies. One bright spot, however, will be that inflation rates will generally be declining."

"In the emerging world there was initially a strong bounceback of economic activity but this is now faltering due to the failure to decouple from the developed economies. The continued heavy dependence of growth in these economies on exports to the developed world means that in most cases domestic demand growth will not be vigorous enough to offset external weakness. In turn, this implies slightly slower real GDP growth rates in 2012 than in 2010 or 2011, but – unlike the Eurozone -- by no means a recession. As in the developed economies, headline inflation rates, which are already slowing across much of the emerging world, will fall further in 2012."