Private equity firm YFM Equity Partners has backed a £5.6m investment into the financial adviser directory service Unbiased.

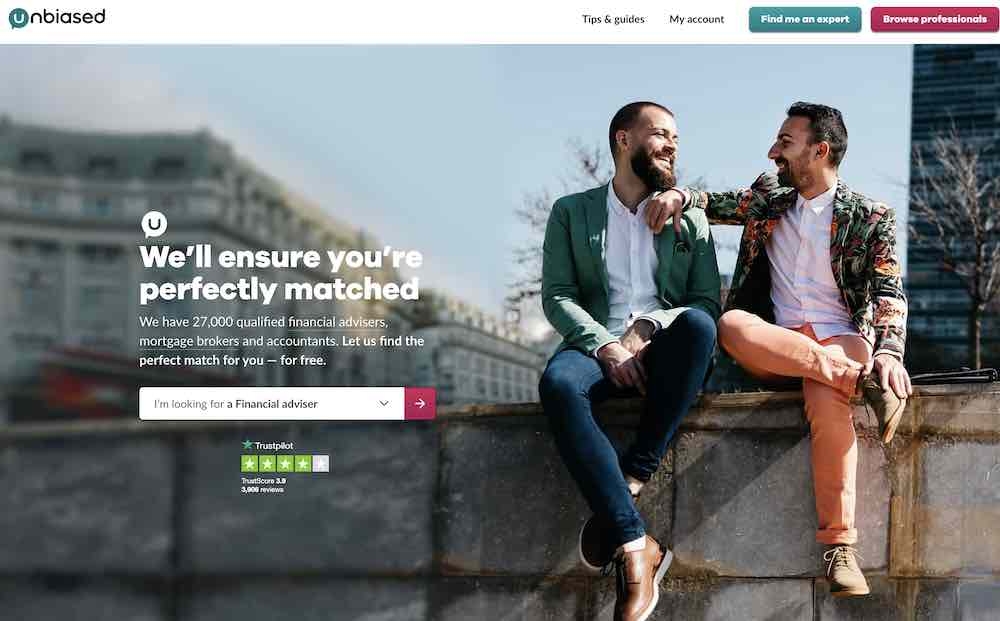

Unbiased is one of the best known online adviser directories and provides consumers with the ability to find local IFAs using a number of criteria including specialisms.

The company will use the money to support the “continued growth of the business as it scales to meet the current market opportunity.”

YFM says, with the FCA suggesting 10m people a year need financial advice, demand for information on locating regulated advisers is set to grow.

Unbiased will use the money to expand its 46-strong team in the UK and overseas and invest in product development and increasing its brand presence.

To raise the money YFM is supporting investment from two VCTs, British Smaller Companies VCT and British Smaller Companies alongside YFM Equity Partners Growth II LP.

The business is led by founder and chief executive Karen Barrett in London.

YFM says Unbiased has seen rapid growth recently with 27,000 professionals now listed on the platform.

Ms Barrett said: “It’s fantastic to have the support of YFM as we look to grow the company and scale Unbiased’s technology.

“I could not be more excited about the opportunities ahead and to have found an investor that understands and shares this vision. We’re now able to capitalise on the huge opportunity that lies ahead and bring the expertise of those on our platform to more consumers.”

Andy Thomas and Helen Villiers led the investment for YFM. Mr Thomas said: “We quickly saw the value that Unbiased delivers to consumers and professional network alike; streamlining the decision-making process.”

• Separately, US fintech firm Broadridge is to acquire fund document and data firm FundsLibrary from Hargreaves Lansdown.