British investors expect average annual returns in excess of 11% over the next five years despite the uncertainty caused by the Coronavirus pandemic.

Four in 10 also say they will turn to advisers for investment help, according to a new study.

The Schroders Global Investor Study 2020 found that average annual return expectations over the next five years edged up to 10.9% for investors globally, with investors in the Americas expecting performance of 13.2%. European investors expected returns of 9.4% on average over the next five years.

British investors had lower expectations, with 8.6% returns expected over the coming 12 months, compared with 10.3% a year ago.

Only 8% of UK investors surveyed for the report expected the negative economic impact caused by the pandemic to reverberate for more than four years. Only 25% expected the ramifications to go on beyond two years.

Those surveyed who claimed to have an “advanced” knowledge of investments were more likely to look to Financial Planners for advice.

Four in ten (40%) 'advanced' investors said they would look to source their financial advice from an independent financial adviser compared with 32% for beginners.

Almost one in three (29%) savers who class themselves as beginners said they were likely to seek financial advice from friends or family, compared with 22% of advanced investors and 25% of experts.

The majority of investors surveyed (64%) stated that they themselves should be responsible for ensuring their knowledge of financial matters is sufficient, ahead of financial providers, advisers and schools.

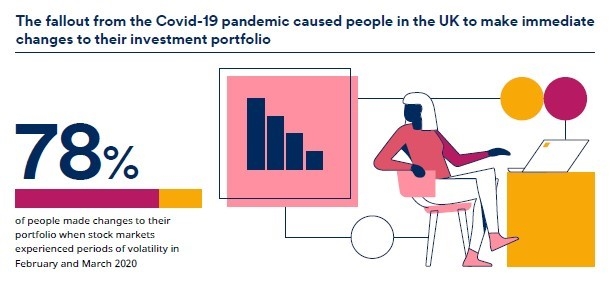

The impact of the pandemic had caused many of those surveyed to make changes to their portfolios.

Over a quarter (27%) of investors moved significant parts of their portfolios to lower-risk investments. As many as 78% made some changes to their portfolios in February and March. Those who rated their investment knowledge as ‘expert’, or ‘advanced’, were more likely to have done so – accounting for 89%.

Other investors (19%) took the opportunity to move some of their portfolio to more high risk investments, while 20% said they opted to do nothing and stuck with their investments as they were.

Older investors appeared to remain calm amid the market volatility caused by the pandemic. All (100%) of those aged 71 or older either moved their portfolio but maintained the same level of risk or opted not to make any changes. This compared to just 16% of millennials.

The pandemic also triggered more focus on savings. Almost half (47%) of investors said they now think about their investments at least once a week, compared with 32% before the pandemic.