A Labour Government led by Jeremy Corbyn coming to power is one of the biggest concerns investors have for stock markets in 2019, according to a new survey of over 700 investors carried out by AJ Bell.

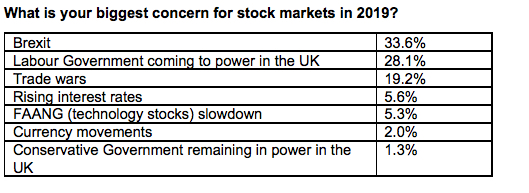

Brexit was the biggest worry with a third of those polled putting that at the top of their list of biggest stock market concerns in 2019, followed closely by a Labour Government coming to power which just over a quarter (28%) of people say is their biggest concern.

Because of these fears half of investors have been stockpiling cash in their portfolio in preparation for a market dip, the study revealed.

Two in five investors (39%) think there will be a stock market correction around the 29 March Brexit date, although just over a quarter (28%) think there will be a stock market rally around that time.

Either way, it is clear that retail investors are building a war chest of cash ready to invest when they feel market conditions are improving.

Almost a third (30%) of investors have reduced their exposure to companies that earn revenue in the UK during 2018, although almost a quarter (23%) are seeing buying opportunities and have increased their exposure to firms that are exposed to the UK economy.

(Source: AJ Bell)

Laura Suter, personal finance analyst at investment platform AJ Bell, said: “Politics is clearly at the top of the worry list for investors with Brexit, a change in Government and Trump fuelled trade wars being the three biggest concerns for next year.

“Financial factors such as interest rate rises, currency movements and a tech-stock slowdown are in a distant second place. It makes a lot of sense that investors are shying away from new investments and reinvesting dividends given the political uncertainty.

“Building up cash reserves to take advantage of buying opportunities may prove to be a smart move, although timing the markets is notoriously difficult.

“What it does suggest though is that once the political fog clears the UK stock market may receive a boost from investors looking to snap up bargains.”