Nearly 50% of pension savers accessed their pension pots in the past 12 months without taking any regulated advice or guidance, The FCA’s Retirement Income Data reveals today.

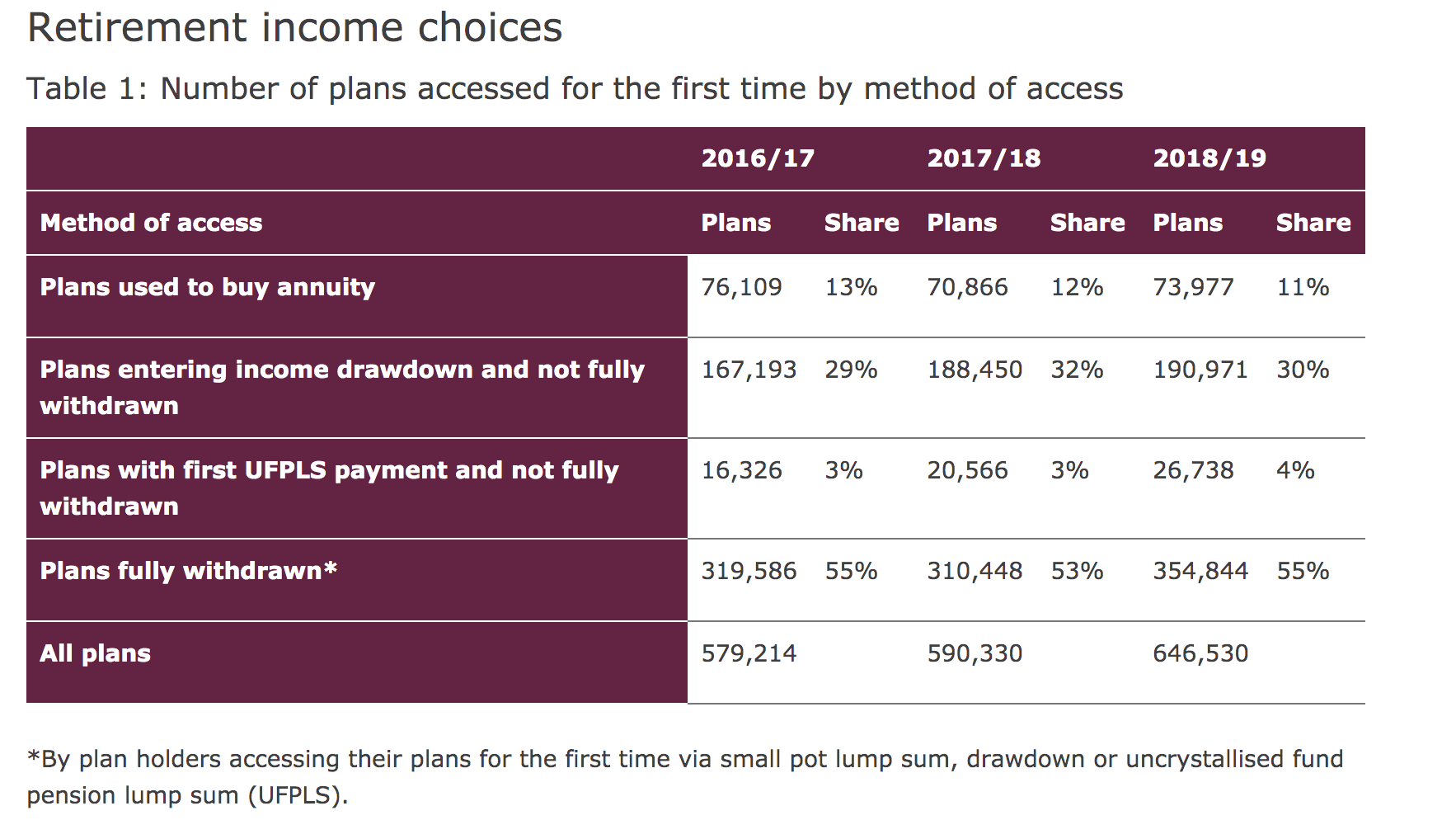

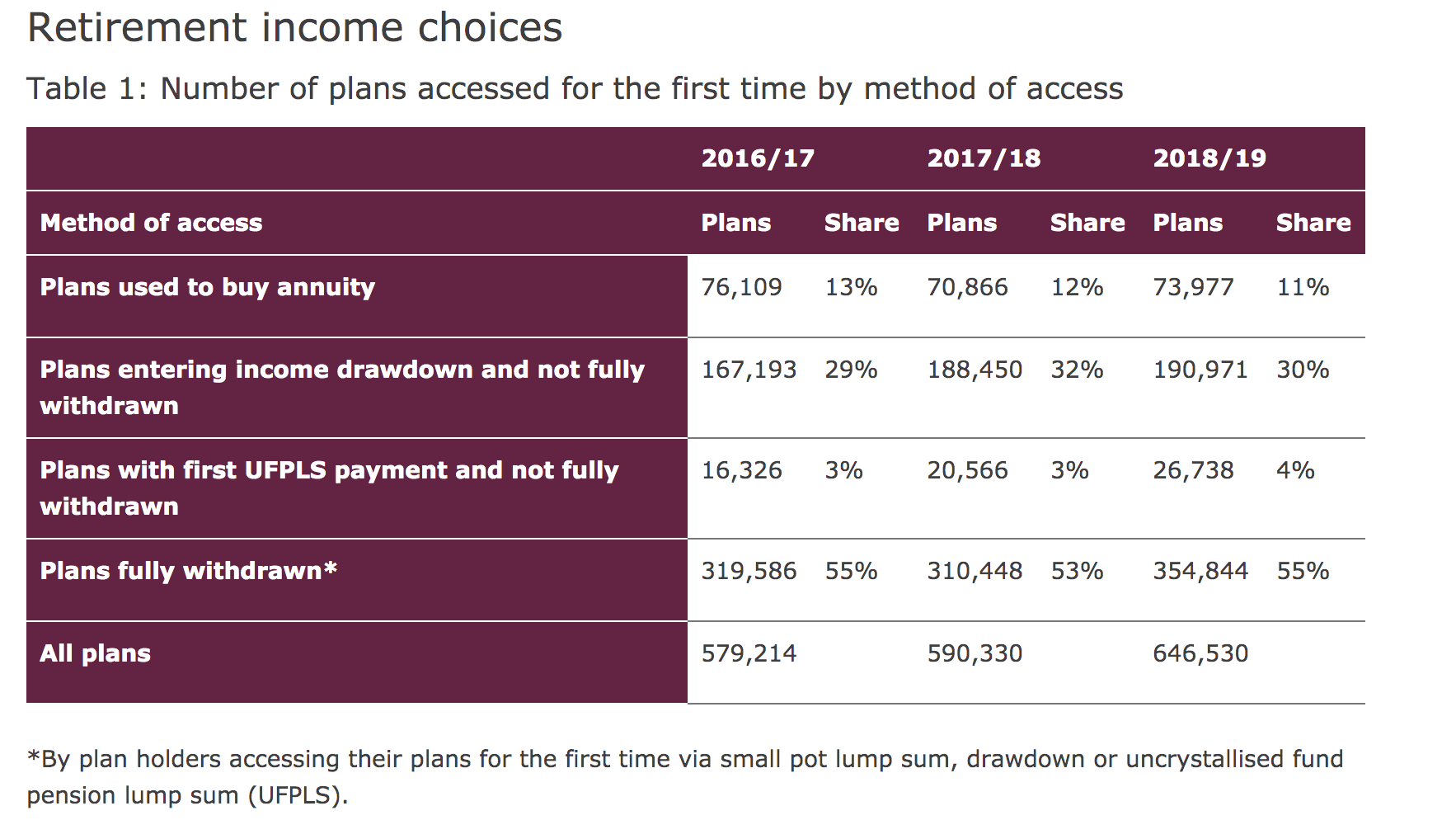

Just over 645,000 pension plans were accessed during 2018/19 to buy an annuity, move into drawdown or take a first cash withdrawal, the regulator reports.

Some 48% of pots were accessed without regulated advice or guidance being taken by the plan holder.

Overall fewer than 4 in 10 pension savers (37%) took regulated advice with 15% of plan holders receiving only Pension Wise guidance.

Some 40% of regular withdrawals were withdrawn at an annual rate of 8% or more of the pot value, says the FCA, considerably higher than the 4% ‘safe withdrawal’ rate used by many professional Financial Planners.

Four in 10 of all the pension pots accessed had a value of less than £10,000 and over 350,000 pension pots were fully withdrawn at the first time of access with 90% holding less than £30,000 in value.

The report also reveals that there were 57,000 defined benefit (DB) to defined contribution (DC) pension transfers.

Source: FCA

Providers reported that in 2018/19 there were 327,500 pension plans where the plan holder made regular withdrawals either by income drawdown or by UFPLS. There were also 141,500 plans from which ad-hoc partial withdrawals were made.

The FCA has been collating data on retirement income since the Pension Freedoms arrived in 2015.

The figures point to a much more disparate pensions income market post the Freedoms with income drawdown and full pension plan withdrawal the most popular options, used by 85% of plan holders.

Detailed tables suggest that the number of pension plans used to buy annuities has declined since 2015, dropping to only 11% of plans accessed in 2018 from 13% in 2016/17.

In contrast plans used for income drawdown have grown and now form 30% of the total although there was a small decline from 2017/18 when income drawn peaked at 32%.

Over the past three years the number of plans fully withdrawn has remained steady at 55% of the total.