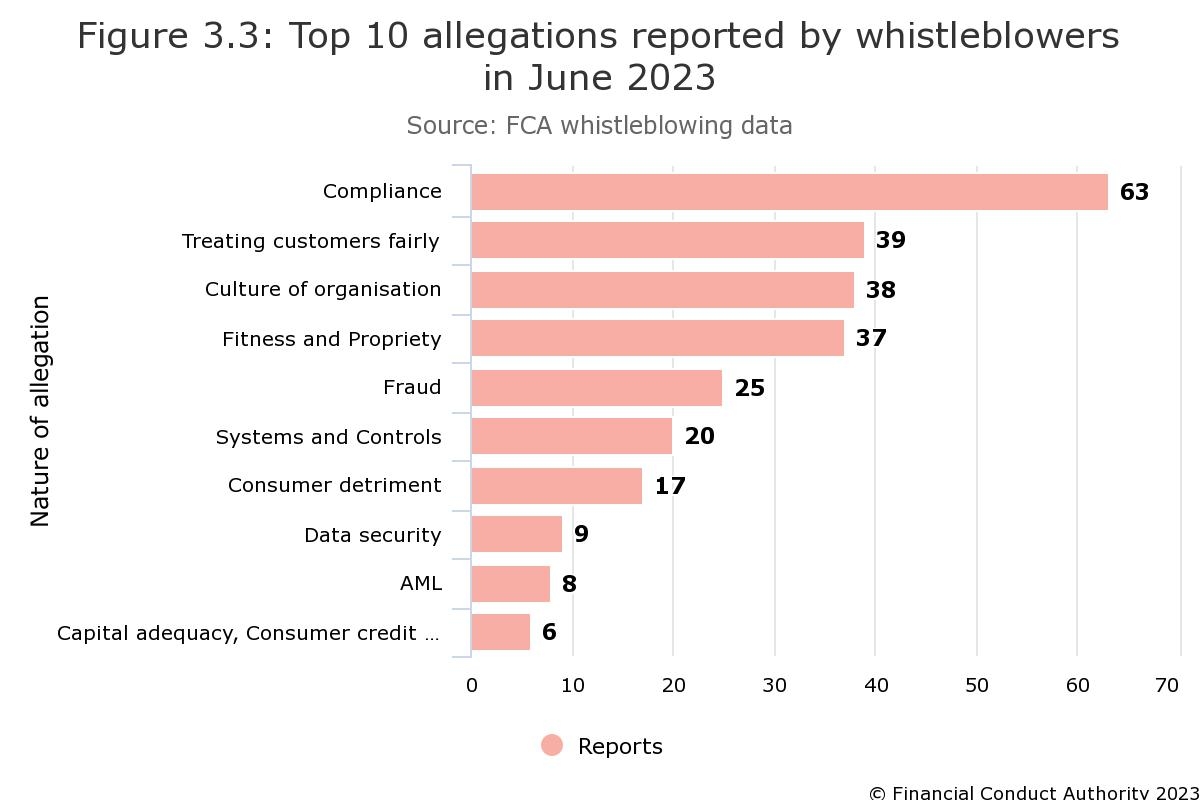

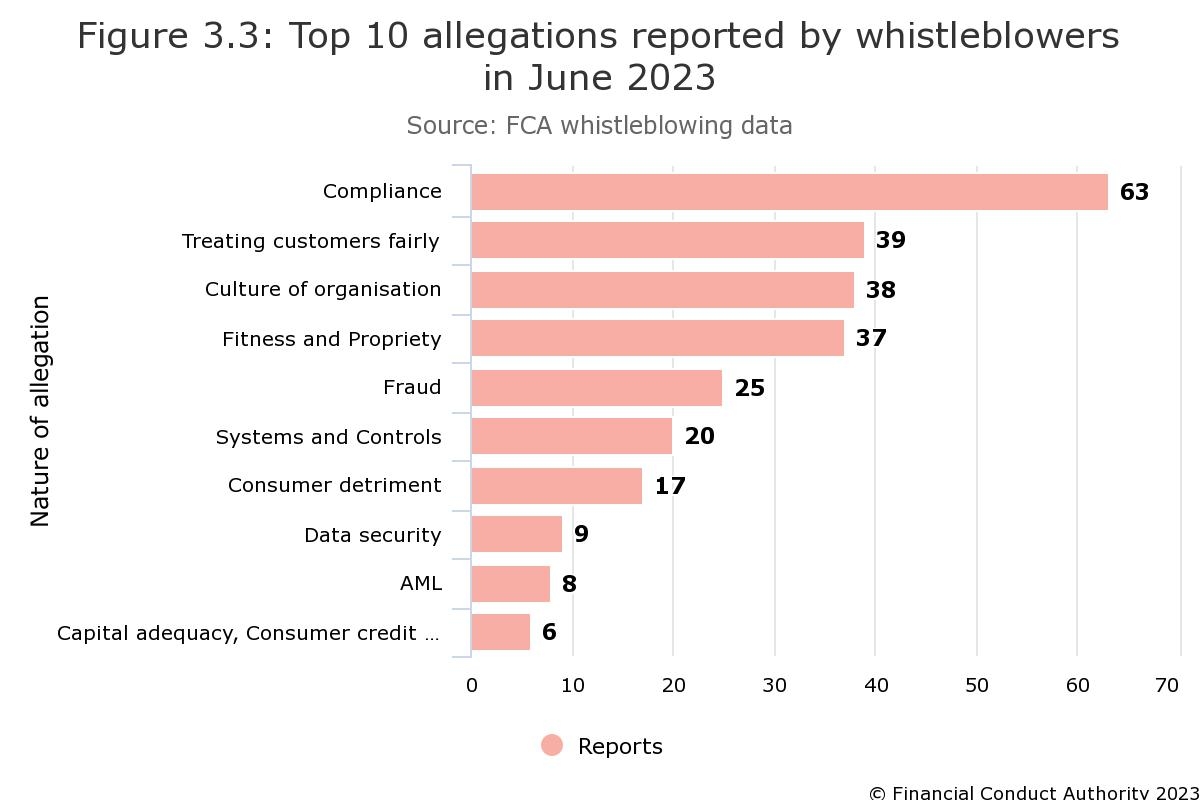

‘Compliance’ was the top reason for whistleblowers to complain to the FCA in June, with 63 reports being made to the regulator about the issue during the month.

It was also the top allegation in May and June with 46 and 53 reports being made respectively.

In Q2 (April to June) the FCA received 300 new whistleblowing reports - 100 a month or more than 3 a day on average. The reports contained 821 allegations in total.

The quarterly figure was a rise of 57 on the same period in 2022 and 20 higher than the 280 whistleblowing reports in the previous quarter of this year.

In June ‘treating customers fairly’ became the second-highest allegation to be reported with 39, climbing ahead of ‘culture of organisation’ and ‘fitness and propriety’ for the first time this year.

The details are revealed in the latest whistleblower figures for the second three months of the year released by the FCA.

In the previous quarter the highest reason for whistleblowers to act was ‘fitness and propriety’ and 'compliance'.

The FCA said: “We assess every whistleblowing case we receive that falls within our remit, to inform our work and help us identify actual or potential harm. This could be harm to consumers, to markets, to the UK economy or to wider society.”

The regulator’s whistleblowing team receives reports by telephone, email, an online reporting form, and post.

It said protecting the identities of the whistleblowers who contact the FCA is vital. “We understand individuals may be hesitant to share their personal information with us when making a disclosure.”

The regulator said it is helpful when whistleblowers provide it with an ongoing contact option such as a phone number and/or email address. “This allows us to re-engage and develop on disclosures and ask further questions. We can also keep individuals informed on how we can protect their identity while we carry out our work.”