The number of newly-opened complaints about decumulation and pensions in the first half of 2023 was up 20% year on year, according to new data from the FCA.

Decumulation and pensions saw one of the biggest rises of any sector, the FCA said in its latest complaints report.

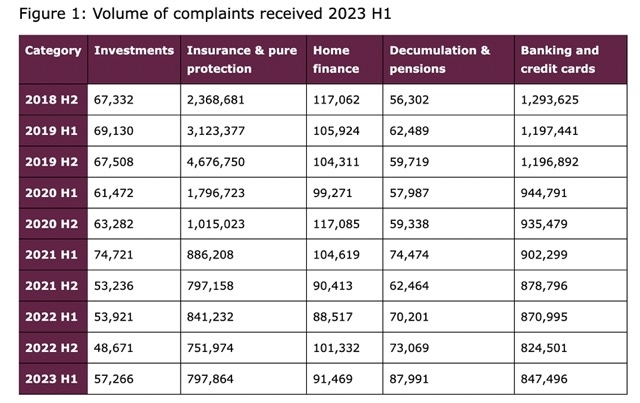

The number of complaints about decumulation and pensions rose by 14,922 (20%) from 73,069 in the first half of 2022 to 87,991 in the first half of 2023.

Total complaints about all financial products received by the FCA rose 5% in the first half to 1.88m, with rises in many pensions and investment areas, according to the FCA report.

There was a particularly large rise in complaints about annuities, up by over 70% from 4,978 in the first half of 2022 to 8,694 in the first half of 2023. Annuity sales have recently soared on the back of much higher annuity rates.

Several product areas are listed as decumulation-related but complaints specifically about drawdown and UFPLS (pension lump sums) rose from 5,012 in the first half of 2022 to 6,326 in the first half of this year.

There was also an 18% rise in complaints about investments. Insurance and protection saw a 6% rise and banking and credit cards saw a 3% rise in complaints.

Complaints about non-workplace pensions (including SIPPs and personal pensions) also rose sharply from 38,629 to 47,413.

The FCA said noticeable increases in opened complaints were also seen in investment and savings (including ISAs) up from 69,373 in 2022 H2 to 85,315 in 2023 H1 (23%).

The percentage of complaints upheld rose from 60% in 2022 H2 to 61% in 2023 H1. Excluding 2022 H2, the percentage of upheld complaints has been steadily rising since 2019 H2, the FCA said.

Redress payments went up by 4% from £228m in 2022 H2 to £236m in 2023 H1, but this was 22% below the 2022 H1 figure of £304m. This year-over-year decline was largely due to a 75% decrease in the redress paid for payment protection insurance complaints, falling from £32m in 2022 H1 to £8m in 2023 H1.

• An earlier version of this article referred to some data as coming from the Financial Ombudsman Service. In fact the data is purely from the FCA. This has now been corrected. Apologies for the error.