As he enters his 75th year, one of the UK's leading SIPP and pensions experts John Moret, still working part-time in the pensions sector, has written a series of articles for Financial Planning Today reflecting on topics that have occupied him over the last 50-plus years. This is the fourth article in the series. Previous articles are available on Financial Planning Today by searching for 'john moret.'

It was with amazement and incredulity that I read of the justification recently by St James Place for its overhaul of charging structures.

Apparently, it will, “separate its new charges into their component parts: advice charges, fund charges and product charges” claiming this will allow clients to consider the value they are receiving from each element of its services.

They went on to say that “it is increasingly evident that consumers are seeking simple comparability and this has been reflected in regulatory trends too, as highlighted with the assessment of value and Consumer Duty regimes.”

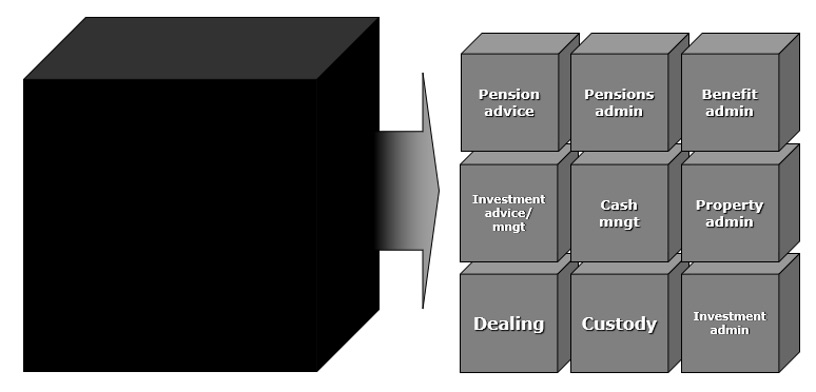

Over 30 years ago when, with colleagues, I was promoting one of the first SIPP products to be launched we designed a simple graphic to illustrate how a SIPP could “unbundle” services and charges into four component parts - administration, advice, investment management and investment administration.

Some years later we refined the graphic to reveal what was inside the “pensions black box” - see the diagram below. This was specific to SIPPs, making the point that ideally advisers and clients should be able to determine just what they were paying for each of the component parts.

In the early days attempts to educate were frustrated by the regulator - LAUTRO - who at the time would not allow “own charge” illustrations. That seems incredible now but then it was just a huge frustration reflecting the fact that “packaged pension” products dominated the retail pensions world. Over time thankfully that changed with the FSA becoming fixated on disclosure of charges - but not in a meaningful way. That approach continued under the FCA with the regulator particularly focussed on administration charges and, as part of the RDR, the cost of advice.

Other charging elements in the “black box” remain far from transparent particularly, in the case of SIPPs, the cash management charges being levied through “skimming” of client bank accounts. That element has been in focus recently with investment platforms cash accounts coming under increasing scrutiny. This is hardly surprising when, for example, Hargreaves Lansdown in their recent quarterly trading statement referred to: “Total revenue in the quarter of £183.8 million (Q1 2023: £162.9m) with net interest margin growth more than offsetting the revenue impact of the reduction in share dealing volumes.” So much for clarity of charges.

The pensions 'black box'. Source: John Moret

The area that remains most obfuscated is investment management charges which, in the context of the black box, also includes investment administration, custody and dealing. Others have written about and campaigned for years about the lack of transparency in this area. In 2021 campaigner and wealth manager Alan Miller of SCM Direct said, “two decades on from research by the City regulator — the Financial Services Authority at the time — showing that up to 50 per cent of fees were hidden, little has been done to rectify the problem”.

Just last week an excellent blog on “transaction cost analysis” on Mallowstreet concluded that “investors should not expect asset managers’ disclosures - driven by regulation or otherwise - to produce the transparency that is required for (what we view as) good practice on this subject.” I am no expert in this area but what seems clear is that we are still some way from the point where all the elements in the “pensions black box” have the clarity of costs that enable investors to make an informed decision.

The Consumer Duty requirements around the “price and value” outcome are a step in the right direction. While any steps towards greater clarity and transparency of pricing are to be welcomed, I would suggest that for the CEO of a leading pensions provider to suggest that separating charges into three simple components is novel and saying it will help clients to assess the value of each component is a little naïve.

As the FCA stated in their non-handbook guidance on Consumer Duty (FG22/5), “where products or services are intended to be sold together as part of a package firms need to consider the value of each component and the overall value of the package."

I suggest there is still a long way to go before the cost of each component in the pensions black box can be identified and their values assessed and accurately compared.

John Moret is principal of MoretoSIPPs consultancy and one of the UK's most experienced SIPPs experts, commentators and speakers. He has worked for Suffolk Life and several other SIPPs providers. He is chair of advisory business Intelligent Pensions and CX insight business Investor in Customers.