Legal action has begun against some employers for auto-enrolment failures, as the regulator revealed it used its powers 10,000 times in the last quarter.

The number of Escalating Penalty Notices nearly doubled from October to December, the Pensions Regulator reported, although the increase in firms declaring is greater.

Some companies are being summoned to court, TPR explained.

In an updated report, it stated: “We’re beginning to see the first employers receive County Court Judgements (CCJs) for a failure to pay their automatic enrolment fines.

"This can happen when they persistently ignore the penalty notices we send them. If they don’t pay up within 30 days of receiving the CCJ, it gets entered on their credit record and remains there for six years, seriously affecting their ability to borrow money for their business in the future.”

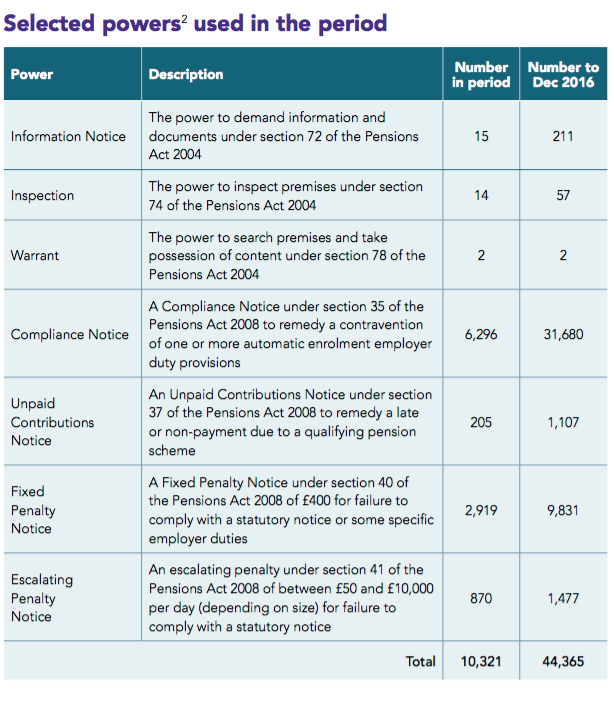

In the three months from October to December 2016, TPR issued 870 Escalating Penalty Notices and 2,919 Fixed Penalty Notices, bringing the total number issued to date to 1,477 and 9,831 respectively.

This is against a backdrop of over 100,000 employers declaring their compliance during the same quarter.

“We’re also seeing an increase in the number of people appealing their fines at Tribunal, and yet so far no employer has been able to show that they had a reasonable excuse for failing to comply. Our message from the last compliance and enforcement quarterly bulletin, that a judge won’t consider an excuse to be ‘reasonable’ except under exceptional circumstances, is now more relevant than ever.”

Pubs, clubs and restaurants are at higher risk of non-compliance, TPR said.

Charles Counsell, automatic enrolment executive director at TPR, said: “The roll out of automatic enrolment has been accompanied by a succession of doom-laden prophecies that haven’t come true.

“The fortune tellers have been wrong, but I agree with one commentator who stated over the new year that as we entered 2017 the job is far from done. Success does not build complacency and I know that new and even greater challenges lie ahead.

“Over the coming year, we will be helping to steer more than 700,000 small and micro employers through their workplace pension duties.

“My team and I remain committed to doing all we can to maintain the high levels of compliance we have seen so far and there’s plenty of information and help available to ensure employers can meet their duties.

“But we are clear too that if an employer does not comply with the law then they will face enforcement action. This is a key part in changing behaviour and making compliance the norm. The expectation of the majority who comply is to ‘see’ that those who don’t will face some punishment.”