A cybercrime style hack will be undertaken live at a conference this month to demonstrate the threat posed to wealth managers and finance firms.

The Wealth Management Association’s annual Financial Crime Conference at the Guildhall in London on 28 January will feature a mocked up hack from expert Mustafa Al-Bassam, who was described as an ethical hacker.

Security experts such as Mike Betts, a detective inspector from the City of London Police, will also be among the guest speakers.

The WMA said it recognises the “huge importance of tackling this issue, both for its member firms and their clients”.

A PWC survey found that cybercrime was the second most common type of economic crime reported by financial services after asset misappropriation.

According to the ONS annual crime report there were 2.5 million cybercrime offences directly affecting individuals between May and August 2015, an average of 625,000 a month.

The report highlighted the fact that more than 20 per cent of all cybercrime victims incurred a loss a higher than £500.

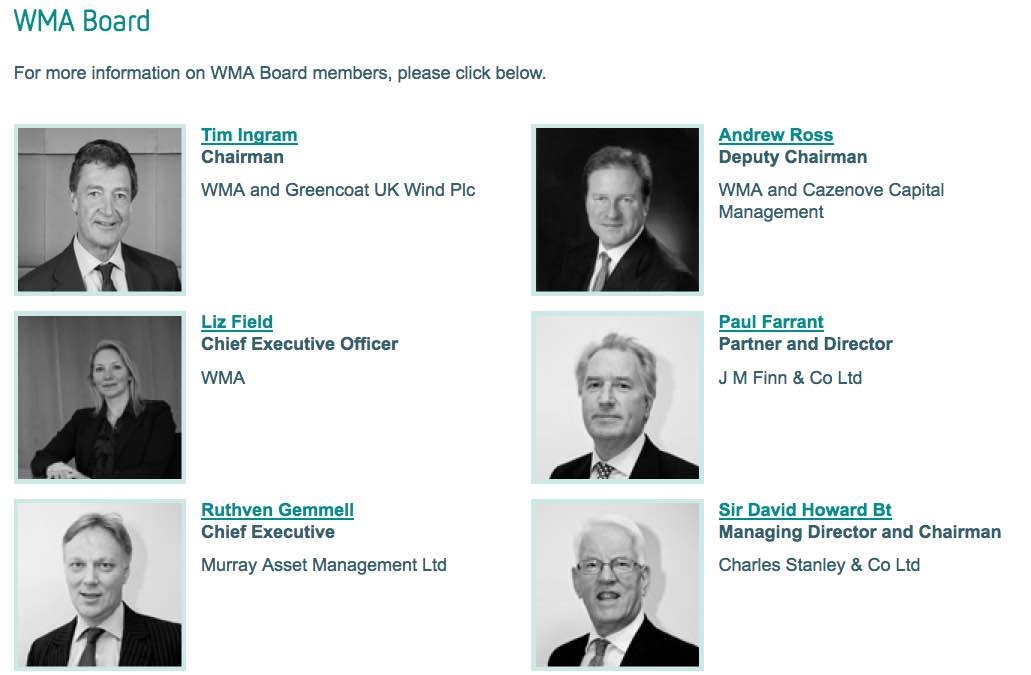

Liz Field, chief executive of WMA, said: “Cybercrime is of particular interest to financial organisations, not only because they manage clients’ assets, but also because they hold large volumes of sensitive client data.

“The misappropriation of such data can lead not only to direct financial loss and severe reputational damage for companies.

“The conference will further contribute to spreading awareness within the industry and making cybercrime a top priority, with the aim of creating an environment in which a culture of savings and investment can thrive safely.”

The ONS figures also showed another 37 per cent of people who were victims of cybercrime suffered losses ranging from between £100 to £500.

Only 41 per cent of industry respondents to a recent PWC study said they thought they may experience any form of cybercrime in the next 24 months.

But Ms Field believes firms need to be alert to the problem, saying: “As an industry, finance faces considerable losses from cybercrime as there have always been significant potential financial gains to be had and valuable sensitive information to be stolen.”

The WMA said it is working with the National Crime Agency to ensure best practice.