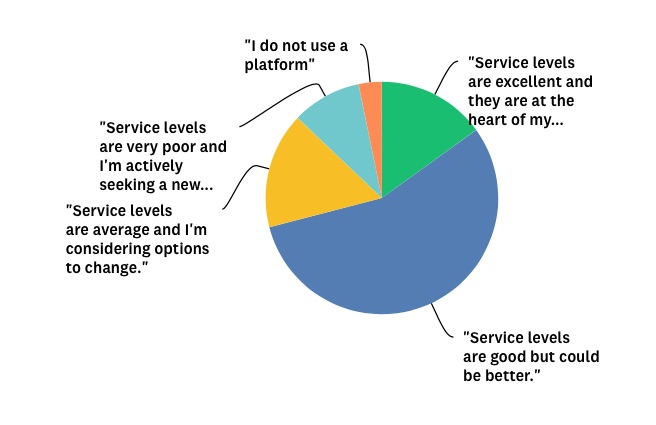

Financial Planning Today magazine recently conducted a reader’s survey, which found about 26% looking to switch platform because they felt the service failed to be adequate.

Just over a quarter of the 93 respondents either said the service was very poor or average and they were seeking a change.

Some 15% said service levels were excellent and 56% said they were good but could be better.

FP Today asked platforms expert Mark Polson, founder of the Lang Cat, for his views on how platforms are performing in terms of their service.

Read below for his thoughts...

Service is perhaps the most nebulous concept around platforms – but it’s also one of the most important. The problem is, no one really knows what good looks like, and there’s no way of measuring it.

Most service ratings are based on pitifully small samples, which in other industries would be laughed at. So planners have to screw their courage to the sticking-place (or trading-place) and just experience it for themselves.

Once that’s done, the service experience needs to be detached from the online user experience – the latter will be a niggle for many firms, but really bad experience can get people to jump ship. We’ve seen this with pensions administration in particular.

In fact, service is one of the very few things that will get planners to vote with their feet. We’ve seen proof over many years that price is a really bad determinant of where flow will go.

Perceived service quality – usually through recommendations from peers - is much more important. When we do due diligence exercises at the lang cat on behalf of firms, we normally seek out existing users (not via the provider) to try and get this perspective.

The latest Financial Planning Today magazine is out and available to read below...https://t.co/BBvoXy7IWj pic.twitter.com/wOeisaeG7P

— FP Today Magazine (@FPTodayMagazine) July 17, 2017

All this shakes out to the fact that the devil you know beats the one you don’t, and that’s what I suspect drives these results (of the FP Today reader survey).

They’re not a surprise – the pain involved in moving portfolios is, er, painful, especially if your clients are well diversified.

You may have had mixed experiences – but what if your new home is even worse? We end up with a sort of ‘meh’ stasis, which I suspect drives the 55% of responses, which said that things were good enough, but could be better. Which is the sort of thing my maths teacher used to say about my homework, and we all know how that ended up.

In terms of service experience, I don’t know a single platform that doesn’t want to deliver really good service. No one sets out to do a bad job. But there is a constant tension between commercial reality (investing in kit and people) and delighting advisers and planners.

In my experience, the three things that usually lead to happy faces are:

- Named contacts

- Case ownership (so no getting passed around to the claims team etc)

- Good communication

All of these are basics, but are so often missed. It’s safe to say that firms who nail the basics will do well. Anything else is a bonus.