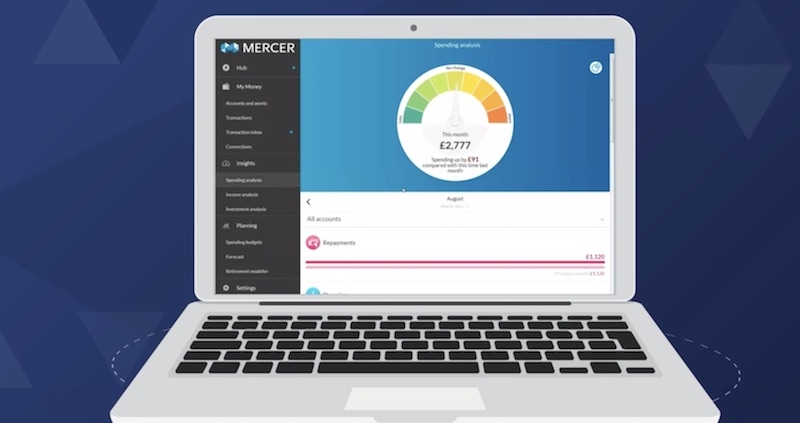

Mercer has unveiled Mercer Money, a personal finance and ‘financial wellness’ platform allowing a company’s employees to manage their personal finances in one place.

The system uses Open Banking and other digital technology to provide a real-time view of current accounts, debt, savings, pensions, investments, mortgages and property values. There are also budgeting and transaction tools.

The company says that Mercer Money allows individuals to make “better financial decisions for the short, medium and long term.”

One aim is to improve ‘financial wellness’ and pension engagement by allowing employees to keep on top of their financial commitments and investments and avoid stress and anxiety around money.

Benoit Hudon, UK wealth leader for Mercer, said: “Many employees struggle to understand their pensions and get a comprehensive view of their finances. They have to juggle multiple conflicting financial demands daily resulting in increased stress and difficulty when making decisions.

“Mercer Money has been designed to support better financial decision making and help improve people’s lives today while giving them peace of mind that their future needs are met.

“Our Mental Health at Work report recently revealed that 24% of employees who experienced poor mental health symptoms cited financial difficulties as a cause.”

Mercer Money forms part of the Mercer Master Trust. Employees that leave their employment will continue to have access to the services it offers, as long as they keep their deferred membership in the Mercer Master Trust.

Mercer has more than 25,000 employees in 44 countries and is part of Marsh & McLennan. In the UK Mercer Limited is regulated by the FCA.