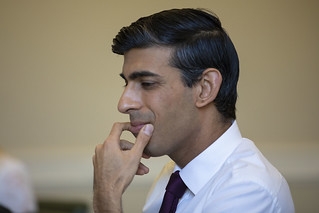

The industry has given a mixed review to news that Chancellor Rishi Sunak has asked The Office of Tax Simplification to carry out a review of Capital Gains Tax.

AJ Bell has warned the moved could be a precursor to a “tax grab” by the Chancellor to pay for the pandemic but Sean McCann, Chartered Financial Planner at financial advisers NFU Mutua,l says the move could lead to a welcome simplification of complex CGT rules and pave the way for easier transfer of assets down the generations.

The Chancellor has asked the OTS to review Capital Gains Tax and the OTS has published an online survey and called for evidence.

The Chancellor wants the OTS to undertake a review of Capital Gains Tax (CGT) and “aspects of the taxation” of chargeable gains in relation to individuals and smaller businesses.

He wants to ensure the system is “fit for purpose.”

The OTS wants to hear from individuals and businesses as well as professional advisers and representative bodies. More information is available here: https://www.gov.uk/government/organisations/office-of-tax-simplification

The survey is open now and will be available until the end of the summer. The call for evidence comes in two sections: the first seeks high-level comments on the principles of CGT by 10 August, while the second section seeks more detailed comments on the technical detail and practical operation of CGT by 12 October.

Views are mixed on the intention of the review.

Tom Selby, senior analyst at AJ Bell, believes the review could herald a move to increase the government’s take from CGT.

He said: “With UK borrowing set to hit its highest level in peacetime history, Chancellor Rishi Sunak’s request for a review of CGT feels like the starting pistol for a tax grab ahead of the Autumn Budget later this year.

“Given those who pay CGT are twice as likely to pay higher-rate (40%) income tax as taxpayers generally, the Treasury may have its sights set on aligning CGT rates and income tax rates. CGT rates are currently set at 10% for basic-rate taxpayers and 20% for higher and additional-rate taxpayer (18% and 28% where gains relate to residential property).”

However, Sean McCann, Chartered Financial Planner at financial advisers NFU Mutual, said the Chancellor may simply want to clean up CGT.

He said: “The Chancellor’s review into Capital Gains Tax is a welcome one. There are many traps with CGT that can spring nasty surprises.

“Given the economic situation facing the younger generation due to the Coronavirus pandemic, it would make sense to simplify the rules to encourage the older generation to pass on wealth during their lifetime."