Millennials are saving more and deciding more often to use and stick with automatic enrolment pensons in the workplace, new research has found.

Research by pensions and investment firm Royal London has found that almost three quarters of millennials - those born between the early 1980s and early 2000s - are deciding not to opt out after being automatically enrolled on a workplace pension, with a further 8% saying they opted out but then went back in.

Additionally, 75% who have a pension said they would increase payments automatically if they received a pay rise, while 40% said they were planning to increase their monthly contributions next year.

Royal London’s research also tested millennials’ awareness of the planned automatic rise in pension contributions, which will increase to a minimum total contribution of 5% in 2018 and 8% in 2019.

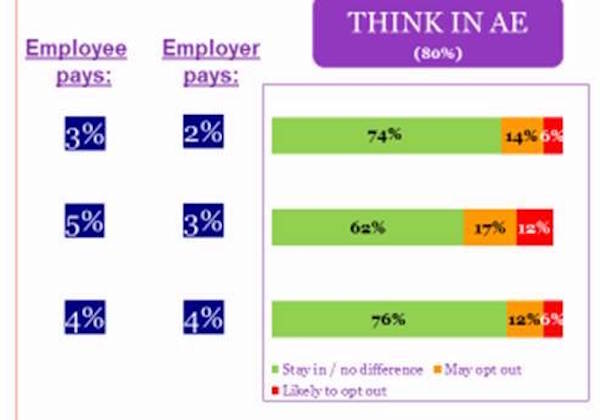

Nearly three quarters said they would continue to make payments into their pension if it increased, with this being based on the idea that if payments increased to 5%, a 3% contribution would be made by an employer and 2% by the person themselves.

If automatic enrolment contributions increased to 8%, with the employee paying 5% and the employer 3%, 62% still said they would make a monthly payment into their pension.

However, if contributions increased to 8%, but payments were matched, 76% said they would continue to save in their pension.

As part of its research, Royal London surveyed 1500 millennial respondents aged 25-34 through online interviews, with these being conducted between the 21 and 29 June 2017.

Jamie Clark, pensions business development manager at Royal London, said: "It's encouraging to see that auto-enrolment is welcomed by millennials and that the potential concern that many would opt-out when the increases come into effect next year appears to be misfounded.

“Increasing saving into a pension can seem daunting and difficult when there are other financial priorities and pressures. It’s great to see that automatic gradual increases in contributions, perhaps in line with pay rises, is potentially viewed by millennials as a way to help lessen the financial impact.”

He added: “Providers, employers and financial advisers all have a duty to ensure employees are engaged in their future pension planning as soon as possible and fully understand the consequences of opting out of their workplace pension. And although saying they are saving, there is the risk some may still sleepwalk into poverty in their retirement by not regularly reviewing their savings and not taking advantage of opportunities to increase their pension savings when possible.”