Mums have lost hundreds of millions of pounds in retirement, a pensions firm has calculated, because of a change in the rules on child benefit.

Mothers are missing out unnecessarily on vital pension rights, according to new analysis by mutual insurer Royal London.

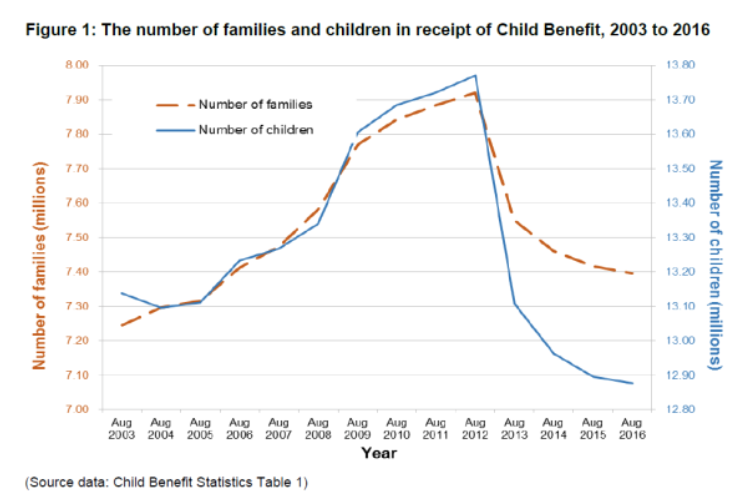

Figures published on Friday by HM Revenue and Customs showed a doubling in the number of mothers missing out.

This relates to the introduction in January 2013 of the ‘High Income Child Benefit Tax Charge’.

Royal London estimated that the number of mothers affected has more than doubled in the last two years and now stands at around 50,000.

The rule meant that couples where one partner earns more than £60,000 per year have the value of their Child Benefit ‘wiped out’ by a tax charge. In response to this, growing numbers of mothers starting a family since January 2013 have declined to claim Child Benefit at all, the Royal London report stated.

But this means they are missing out on vital National Insurance credits towards their state pension, officials added, saying that each year missed could cost 1/35 of the value of the state pension – around £231 per year or over £4,600 over the course of a typical 20 year retirement.

Table: Royal London/HMRC

The HMRC document stated: “The number of children for whom Child Benefit is being paid is now at its lowest level since HMRC began producing these statistics (in 2003)”.

Ex-Pensions Minister Steve Webb, director of policy at Royal London, said: “Tens of thousands of mothers with young children are missing out on vital state pension rights.

“This risks setting back the cause of equality for mothers by a generation. HMRC were alerted to this problem last year and have done nothing about it.

“These new figures are a damning indictment of a system that is no longer working for families. The Government needs to take urgent action to ensure that mothers get the pension protection to which they are entitled”.