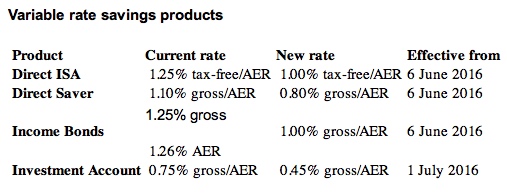

NS&I is reducing the interest rates on five of its variable rate products and will also also be changing the fixed interest component offered to Index-linked Savings Certificates customers whose investments are maturing.

The decision follows publication of NS&I’s Net Financing target for 2016-17 which stands at £6 billion, within a range of £4 billion to £8 billion. In the current financial year, NS&I is forecast to raise £11.5 billion in Net Financing against a £10 billion target, within a range of £8 billion to £12 billion.

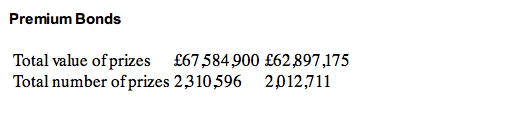

The variable rate changes will apply to Premium Bonds, Direct ISA, Direct Saver, Income Bonds and Investment Account. Changes to Index-linked Savings Certificates will only affect those customers who renew Certificates which mature on or after 28 March. NS&I will be notifying customers holding affected variable rate savings accounts over the coming weeks.

Jane Platt, chief executive, NS&I, said: “It is always a difficult decision to reduce rates, but downwards movements in interest rates across the cash savings market mean that our rates have risen in the competitor tables.

“NS&I aims to strike a balance between the needs of savers, taxpayers and the stability of the broader financial services sector, while raising the required level of Net Financing for the Treasury. These changes will allow us to manage demand in order to achieve our new Net Financing target, and deliver positive value to taxpayers.

“The majority of the new interest rates on offer are either at, or above, average market rates. We believe they present a fair offer to customers, who will also continue to benefit from our 100% HM Treasury guarantee on all holdings, as well as tax-free prizes for Premium Bonds.”

On Index-linked Savings Certificates (not currently on sale but still available to customers who already hold the product and reach the end of their investment term) the fixed interest component of the rate (paid in addition to index-linking) will reduce from 0.05% to 0.01% for customers who renew Certificates which mature on or after 28 March. However, NS&I says that where it has already written to customers and offered the higher rate, it will honour that rate if customers choose to renew their investment for another term of the same length.