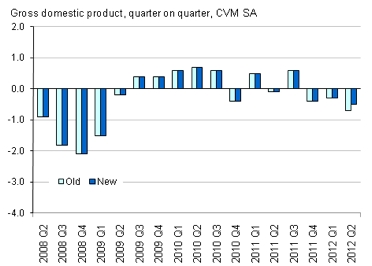

The Office for National Statistics says that UK gross domestic product in volume terms decreased by 0.5 per cent in the second quarter of 2012, revised from the previously estimated 0.7 per cent decline.

Output in the production industries fell by 0.9 per cent, within which manufacturing output also fell by 0.9 per cent. Output of the services industries fell by 0.1 per cent, while output of the construction industry fell by 3.9 per cent.

Household final consumption expenditure decreased by 0.4 per cent in volume terms in the latest quarter while, in current price terms, compensation of employees rose by 1.8 per cent in the second quarter of 2012.

Manufacturing output fell by 0.9 per cent in the second quarter of 2012. This compares with a decrease of 0.3 per cent in the previous quarter.

Construction output decreased by 3.9 per cent in 2012 quarter two. This compares with a decrease of 4.9 per cent in 2012 quarter one.

Services output decreased by 0.1 per cent in the second quarter of 2012 compared with an increase of 0.2 per cent in the first quarter of 2012.

Output of the business services and finance industries fell by 0.1 per cent in 2012 quarter two, compared with a decrease of 0.3 per cent in 2012 quarter one.

ONS says the second estimate of GDP indicates that the economy contracted by slightly less during the second quarter than had previously been estimated. This mainly reflects the availability of additional data from surveys and administrative sources.

ONS says the estimate has been revised from a fall of 0.7 per cent to a fall of 0.5 per cent which indicates a mild contraction and reflects the difficult economic conditions faced by businesses and consumers, domestically and globally. It is also noted that the additional public holiday and bad weather during the second quarter may have adversely affected economic performance.

The main causes of the revision to GDP came from upward revisions to both the construction and production industries, with each contributing approximately 0.1 percentage points to the upward revision to GDP.

Indicators outlining the economic and financial conditions facing households and businesses continue to be weak or adverse. Wage growth remains weak and the climate for major economic purchases remains subdued. Businesses seem to be undertaking defensive strategies involving cost cutting, rather than increasing capital spending.

The independent Office for Budget Responsibility (OBR) reduced its forecast for UK business investment in 2012 to an increase of 0.7 per cent, down from 7.7 per cent last November. Low expectations are likely to be a result of the continuing Eurozone debt crisis and weak domestic growth.

In contrast the headline indicators for the labour market for quarter two showed remarkable resilience. Between January to March 2012 and April to June 2012, employment increased and unemployment and inactivity fell. Employment increases were broadly based with increases in full time workers (130,000) and part time workers (71,000). These figures are in line with an increase of 1.8 per cent in compensation of employees this quarter.

The weakness in GDP growth in the second quarter may have been affected by the changed timing of bank holidays or the bad weather this summer. These short term factors would not be expected to have a significant impact on headline labour market indicators such as the levels of employment or unemployment.

The weakness of growth over the last three quarters means that GDP is now around the same level as it was in the second quarter of 2010, so GDP growth has been broadly flat over the last two years.