The platform sector saw continued rapid growth in the second quarter thanks to inflows from Pension Freedom business and ISA sales, according to analysts.

Defined benefit pension transfers now also appear to be fuelling growth on platforms as transfer values soar, according to the research by platform analysts Fundscape.

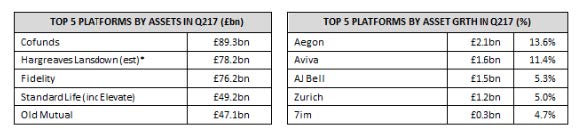

Assets under administration on platforms rose by £19bn (4%) to £539bn, while gross and net sales climbed to new highs of £34bn and £14.4bn respectively. The top five platforms by assets are Cofunds, Hargreaves Lansdown, Fidelity, Standard Life and Old Mutual (see table).

Gross sales in the second quarter jumped to £34bn — up 13% on the previous quarter, and 37% on the same quarter of 2016. Year to date sales stand £63bn.

Net sales of £14.4bn were also healthy, said platform analyst Fundscape, representing a 6% increase on Q1 2017 and a significant 50% increase on the same quarter of 2016.

Year to date sales stand at £28bn. Apart from Hargreaves and Cofunds, platforms in the top five by net sales achieved growth by exceptionally strong SIPP and pension sales.

Bella Caridade Ferreira, chief executive of Fundscape said, “It was another exceptional quarter for the platform industry. With gross and net sales of £6.3bn and £3bn respectively, ISA business was the second best on platform industry records thanks to a combination of last minute and early bird investors taking advantage of their ISA allowances in April.

“Nonetheless, the real momentum came from pension flows. With the advent of Pension Freedoms, investors and their advisers are reorganising and consolidating pensions on one platform. As a result of high transfer values, defined benefit transfers into DB schemes are also a defining factor of the pension trend.”

Ms Ferreira said, “Setting aside any Brexit related slowdown and the impact of Mifid II and other regulations in the pipeline, we expect pension business to continue to drive strong platform activity in the mid to long term. As a result of the focus on pensions, future platform enhancements will be targeted at delivering the best possible retirement products coupled with the investment solutions to manage them.”

A total of 19 platforms were included in the latest Fundscape analysis. Platform coverage is estimated at 98% of the platform sector.