The number of pension withdrawals continued to soar in the third quarter of 2018 leading to suggestions that some pensions savers are treating their pensions like bank accounts, tapping them for cash when they need it.

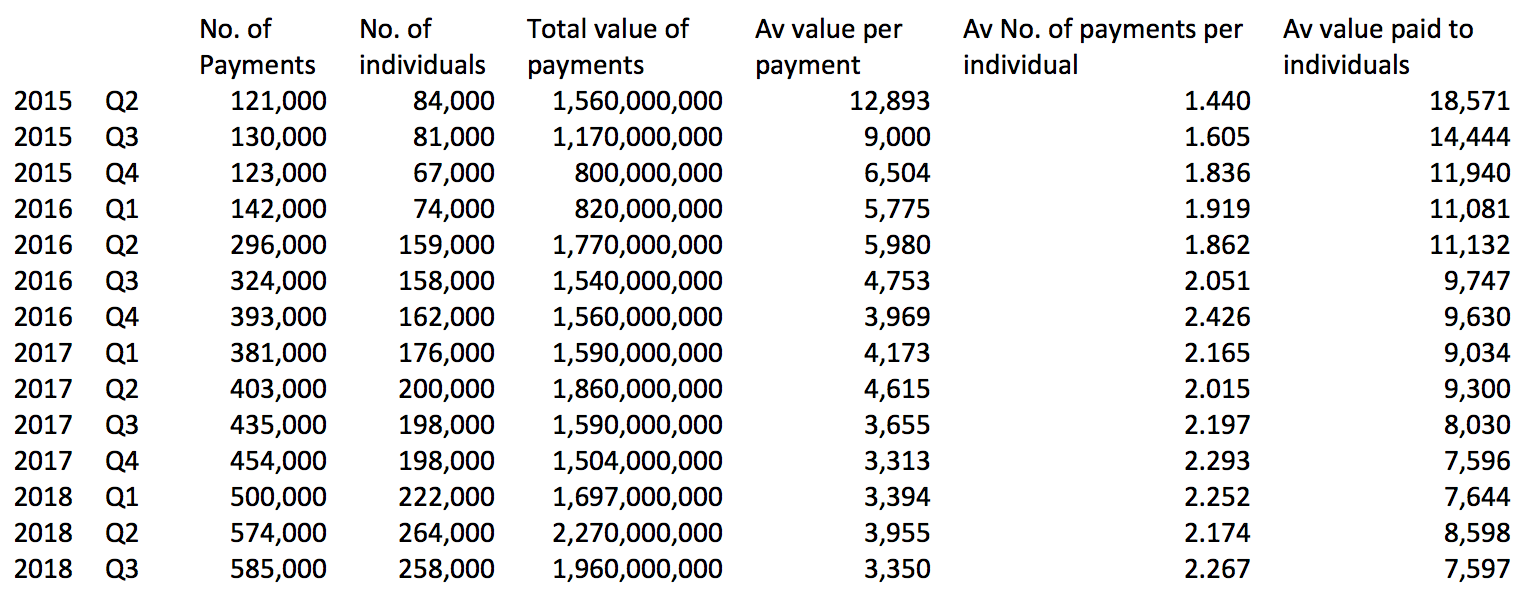

HMRC’s latest figures published today show that 585,000 withdrawals were made by 258,000 people in Q3 of 2018 - slightly down from the 264,000 seen in Q2 - with total withdrawals in the quarter at nearly £2 billion.

The number of withdrawals has topped 500,000 every quarter this year but no quarter was above 454,000 last year.

In the three and a half years since the Pension Freedoms were introduced in 2015, nearly 5 million withdrawals have been made by over 1.3m people, totalling £21.6 billion.

Average withdrawals per person were £7,597 during Q3, showing a downward trend.

Source: HMRC

Canada Life’s pensions technical director Andrew Tully says the the Treasury is enjoying a ‘tax bonanza’ as pension savers treat their pension “more like a bank account.”

Mr Tully said: “Typically smaller pensions are being fully withdrawn, while people with larger pensions are making multiple withdrawals in a tax year, suggesting they are treating their pension more like a bank account.

“These pensions are also being accessed for the first time before state pension age. This combination of taking multiple withdrawals in a tax year at earlier ages, when people are still likely to be earning income from work, means many people are likely to be paying more tax than if they took withdrawals more gradually.

“The Treasury is enjoying a tax bonanza, as predictions that paying income tax will be a natural brake on withdrawals hasn’t stopped people simply taking the money.”

Canada Life says the latest HMRC pension scheme newsletter (published 31 October) has confirmed around £38m has been refunded in overpaid tax following the application of emergency tax rules on pension withdrawals in the last quarter, as many people continue to “overpay” at the point of withdrawal.

Tom Selby, senior analyst at AJ Bell, said: “The Government recently upgraded its estimate for the tax take from pension freedoms withdrawal this year by a whopping £400m and now we can see why. The UK public has latched on to the flexibility the new rules gives them and as more people hit age 55 we can expect these figures to keep rising.

“Importantly though, it looks like most people are taking a pragmatic and controlled approach to how they manage their pension savings with the average withdrawal per person on a downwards trajectory. There was an initial rush for cash when the new rules came into effect in 2015 but since then the average withdrawal has plunged from £18,571 to £7,597 in Q3 this year.”

Ian Browne, pensions expert at Quilter, said: “Pension freedoms is beginning to imbed in society as recent figures from HMRC reveal that the number of individuals accessing their pension flexibly and the amount they are taking per payment is starting to hover around the same figures over the past few quarters. However, these figures may start to tell a different story soon, as freedoms is in for a whole new set of challenges given increased investor jitteriness during market volatility.

“In the three years since the pension world shifted, investors have enjoyed buoyant markets, with both the FTSE and US indices breaking records. Now, the last number of months have seen dramatic swings in the market and it’s understandable that people are nervous about their future retirement, particularly if it’s only around the corner.”