Financial Planners are continuing to diversify their business offerings with a wider range of wealth management and professional services, according to our annual Financial Planning profession reader survey.

There was a marked increase in the number of Financial Planners offering a wider range of services in this year’s Financial Planning Today magazine reader survey compared to last year.

One service area which has seen rapid growth for Financial Planners in recent years is estate planning. Over half (52%) of our readers now offer estate planning, perhaps due to recent highly-publicised rises in inheritance tax receipts or an increasing number of planners looking to reach out to future clients by looking to take care of the next generation.

Commonly offered service areas included protection insurance (55%), group and individual pensions (58%), investment management (47%), and ESG investments (29%).

The number of firms offering Corporate Financial Planning held steady at 29% (2021: 31%).

One area which has seen a drop is the number of planners advising on SIPPs and SSAS.

This year just over half (54%) of our readers offered this service in comparison with 62% of planners who transacted SIPP and SSAS business in 2021 and 71% in 2020.

This could be partly due to the bad press the sector has been receiving as a result of the British Steel Pension Scheme scandal, or uncertainty with several SIPP providers entering administration in recent months as a result of accepting non-standard investments.

This year, just 40% of readers told us they currently undertake pension transfer work.

There was a drop in the number of planners offering equity release, with 18% offering this service in comparison to 31% in 2021

When asked what business services they offered to clients, 56% of readers said Financial Planning was the main or primary service they offered.

Over two thirds (69%) said they offer wealth management. While this is a drop from the 86% who said this last year, this is the first year where the number of readers offering wealth management services has been higher than those offering Financial Planning

While there was a time when these two services may have been considered distinct and separate, today there is little difference. Most planners see themselves as offering wealth management as well as other advice services.

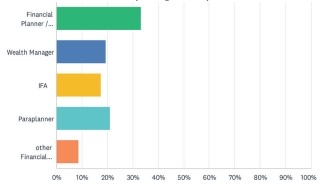

A third of our readers said they would describe themselves as a Financial Planner in the first instance, with 19% preferring to be known as a wealth manager. Other readers would describe themselves as an IFA (18%), a Paraplanner (21%) or financial adviser (9%).

You can read the full article in the latest issue of Financial Planning Today Magazine.

Read a preview of the magazine online today.

- To ensure you receive every issue sign up for our new £9.99 monthly digital subscription package (cancel anytime). You can also upgrade to our Premium Subscription and receive the HD print edition of the magazine. Go to 'My Account' when you are signed in for more details. A digital package gets you unlimited access to the magazine and website plus our valuable 5 Year+ Magazine library. Enjoy dozens of case studies, business-building articles and in-depth features on key topics for Financial Planners, Paraplanners and Wealth Managers.

Only registered readers of Financial Planning Today website can view the full magazine (non-registered readers are restricted to a preview) so please register now for free to avoid missing out and upgrade to a package to get more: www.financialplanningtoday.co.uk