Most Financial Planners are still not technology literate, according to a new report from NextWealth.

Many Financial Planners do not see the opportunities that technology can open for them and their clients, according to the report.

NextWealth said this could leave them vulnerable to “challengers” who enter the market with consumer-technology-led propositions “in their DNA”.

Technology can operate how Financial Planners operate but most lack the skills to efficiently navigate the tech marketplace, according to the NextWealth Adviser Tech Stack report (March 2022).

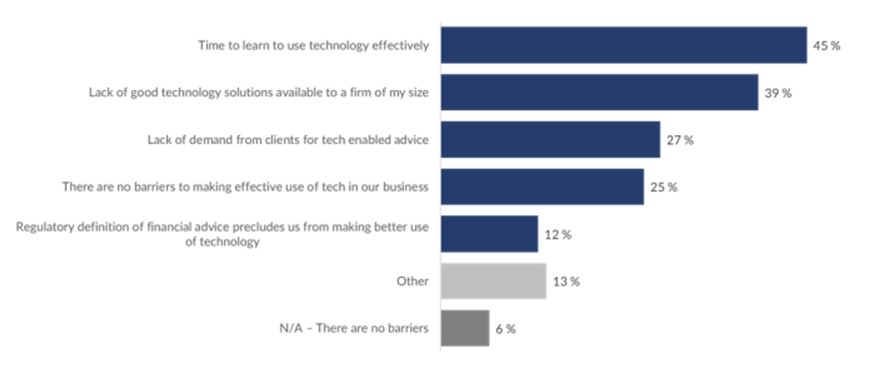

Time to learn how to use technology efficiently was the biggest barrier to adopting new technology among financial advisers, with 45% saying a lack of time was holding them back. A further 39% said they were held back by a lack of good technology solutions available to their size of firm.

Only 25% of advisers said there are no barriers to them making effective use of technology.

Overall satisfaction levels were high with a quarter of advisers ‘very satisfied’ with tools and advice technology available to support key aspects of financial planning. Over 9 in 10 (93%) said they were very/somewhat satisfied with at least one element of tools and technology to support Financial Planning.

Heather Hopkins, managing director of NextWealth, said: "Adoption of new technology is a challenge. Advice tech providers tell us that less than a quarter of the functionality available is used. Advisers tell us that a lack of time to learn to use technology effectively is one of the biggest barriers to adoption. Too often we hear that adviser tech solutions, back-office systems in particular, are cumbersome and difficult to navigate. Tech must be user friendly to be adopted and training and support must be top-notch."

Despite the high levels of satisfaction, the report added that technology providers also need focus on developing systems that are easier to use and more intuitive.

NextWealth said that currently technology providers over-complicate the user experience meaning that it takes too long for advisers to adopt what is on offer or navigate the systems efficiently.

Technology was least likely to be deployed by advisers when it comes to managing client behavior. Nearly one quarter of advisers said they do not use technology to support this aspect of financial planning.

Ms Hopkins said: "Every stage of Financial Planning has been shifting from manual processing to tech enabled practices and new tools and technology are constantly coming to market that promise to deliver greater efficiency and more effective insights.

"The issue is that much of this new tech requires the users to be tech literate and most financial advisers are not. For some, this will be solved by employing specialist IT support. For others, they will adopt a single source approach to technology. Tech providers also need to better understand the issues and to focus on developing systems that are intuitive and easy to use. Until this happens - and vital data is accessible for all - the tipping point for fully integrated, tech-enabled advice that makes the most of humans and robots, will remain a dream, not a reality."