The Personal Finance Society last week put out an urgent warning to advisers about DFM compliance.

The body is urging advisers to review their discretionary investment management agreements amid fears that thousands may be working with inadequate terms.

David Gurr, from the independent due diligence consultancy Diminimis, which has been working with the PFS on developing best practice, said: “This is a problem that has been building for years. The issue has slipped through the cracks and it is only the benign market that has kept it from blowing up.”

Today Mr Gurr, writing for FP Today, explains more and tells financial planners the 5 key steps they should take to review your discretionary agreements.

Read his article below...

During a series of seminars last year less than 2% of advisers admitted to reading the intermediary agreements they had signed with their selected discretionary managers (DIM/DFM). MiFID II requires client agreements that provide legal certainty to enable clients to understand the nature of the services provided, so now is a good time review your current position.

Step 1: What are you trying to achieve when considering a DIM service?

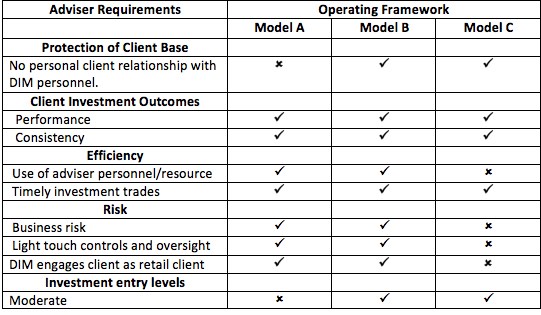

Our adviser clients tell us they require the following;

• Protection of client base.

• Client investment outcomes to be at least as good as they currently are.

• Efficiency in use of resources and administration.

• Business risk reduced, with lighter touch oversight.

• Investment entry levels (variable, not high).

Step 2: Your client agreement?

Is your agreement of an advisory nature? If so, see operating frameworks models A & B below. Does it go further with your client’s authority to act as agent, committing and binding them to the discretionary investment mandate? If so, see model C below.

The latest Financial Planning Today magazine is out and available to read below...https://t.co/BBvoXy7IWj pic.twitter.com/wOeisaeG7P

— FP Today Magazine (@FPTodayMagazine) July 17, 2017

Step 3: What relationship do you want with the DIM?

You are not outsourcing as you are unlikely to have the necessary permissions. Therefore, you are either ‘introducing’ the client or you are the client of the DIM (assuming you have the necessary agreement with your client, as above).

If you are the client of the DIM check if you are being treated as a professional client and understand the implications.

A discretionary service is dynamic and requires an understanding of responsibilities during 3 stages:

• front end obligations,

• establishing the investment mandate with initial client portfolio construction

• ongoing obligations.

The following table outlines three broad operating frameworks that exist within the market. There are numerous sub-sets but this is a good starting point.

Model A; The traditional arrangement whereby the advisory firm arranges for the client to have a direct (contractual) relationship with the DIM.

Model B, based on the MiFID rule ‘reliance on others’; The advisory firm arranges for the client to have a direct (contractual) relationship with the DIM but the DIM relies on the client information provided by the adviser.

Model C, based on the ‘agent as client’ rule; The advisory firm arranges for the investment management to be carried out by the DIM but on the basis the client does not have a contractual relationship with the DIM. Instead, the DIM treats the advisory firm as its client. Applies mainly to MPS on platforms but not exclusively.

Table 1; Who is responsible for what?

Step 4 Using the information from previous steps a framework can be developed.

Table 2 - How do the various operating frameworks meet the Advisers main requirements for working with a discretionary manager?

A tick shows it meets the requirement - a x shows it does not meet the requirement

Step 5 Use the framework as a basis for further clarification.

Does the agreement reflect your requirements? It is a complex issue. If in doubt, get assistance; it is too important to get wrong!