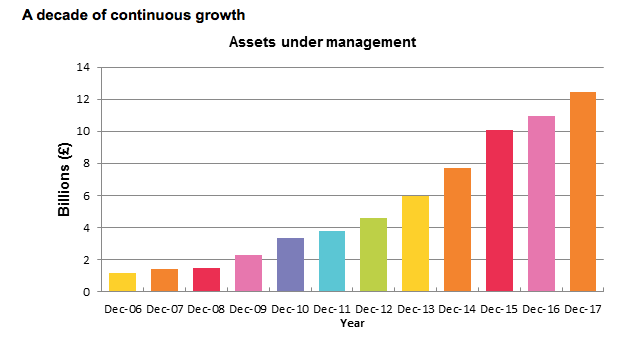

7IM boosted profits and assets for the year ending 31 December 2017, according to its latest annual results.

The investment manager and platform provider, which works with many Financial Planning firms, grew its assets under management by 14% to £12.4bn and boosted profits 4% to £19.4m, compared to 2016.

The firm revealed that 7IM Platform assets were up 19% to £7.7bn and lauded a “decade of continuous growth in assets under management.”

Tom Sheridan, chief executive, said: “2017 was another solid year, with total assets under management up 14% on the previous year and platform assets under management up 19%.

“We know our market and have a service and proposition that resonates with them.”

He said major shareholder Caledonia Investments plc had continued to provide “considerable resources and long term support.”

He added: “With a global, actively managed, multi asset approach using both passive and active strategies and, with the flexibility to manage currency risk, we have a distinctive proposition.

In 2017 the firm launched six new funds: in January the Dublin domiciled fund range was enhanced by the launch of three new Asset Allocated Passive (AAP) funds – 7IM AAP Moderately Cautious (Dublin) Fund, 7IM AAP Balanced (Dublin) Fund and 7IM AAP Moderately Adventurous (Dublin) Fund.

In October three 7IM Dynamic Planner Portfolio Funds were also launched in conjunction with Distribution Technology.