This was the second-highest month in 2012, although it was down from the figure of £730.5m in May.

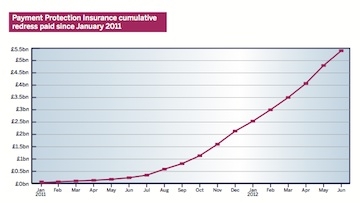

The figure brings the total amount of redress paid since January 2011 to £5.4bn.

Figures are calculated from the 24 firms that make up 96 per cent of complaints about PPI. In 2011, the Financial Ombudsman Service found just 16 firms made up 92 per cent of PPI complaints.

The Ombudsman also highlighted the prominence of claims management companies, saying it received 1,200 PPI complaints every day from claims handlers. However, consumers can be charged up to 30 per cent of a successful refund by a CMC.

The body urged consumers that it was easy for them to claim themselves without the need for a claims handler.

"Making a claim for mis-sold PPI is a free, straightforward process that you can do yourself.

"If you decide to use a claim handler you should carefully consider whether to pay an upfront fee before your complaint is submitted, as there is no guarantee it will be successful and you could be left out of pocket.

"The Financial Ombudsman Service has a free PPI claim form that you can use instead. If you make a claim yourself, you will receive all of any refund you are entitled to."

Earlier this year, the Ombudsman said it expected to settle over 130,000 PPI cases during its 2012/13 business year.

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.