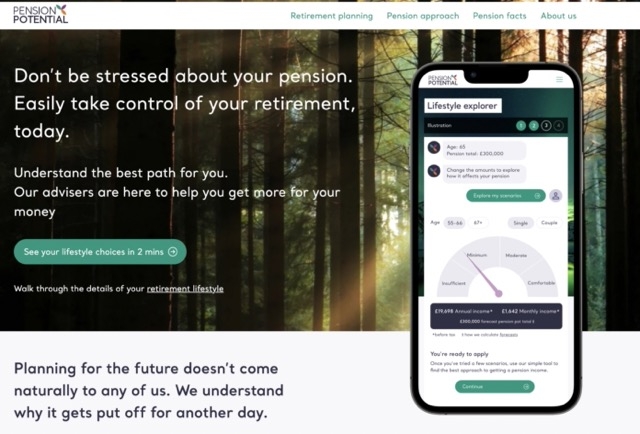

Pensions firm Punter Southall has launched Pension Potential, an app-based digital retirement planning tool for businesses and employees, as well as pension schemes and their members.

The new tool aims to help bridge the pension advice gap and combines an app-based tool with the ability to have a video call with an adviser.

Punter Southall says that Pension Potential will, “take the complexity out of retirement planning” by providing personalised financial guidance and advice to individuals.

The firm says this will empower them to make informed decisions about their pension and retirement options.

The provider says it is responding to recent data from the FCA revealing that one in three savers fail to take regulated advice when accessing their pension.

Punter Southall says that data shows between October 2022 and March 2023, 43,366 pots entered into drawdown with no advice or guidance, equivalent to nearly 40%.

It says this continues a trend of fewer people taking advice when entering drawdown.

Pension Potential provides guidance on retirement choices, including annuities, drawdown, cash, and mixed options. Pension savers can access ‘personalised guidance packs’ and an 'all of market' annuity search feature.

Steve Butler, managing director at Pension Potential, said: "Pension Potential simplifies retirement planning; ensuring individuals can achieve their retirement goals. People can often feel overwhelmed when thinking about their retirement, but by bringing together key information all in one place, along with access to low-cost advice, people can easily understand how to achieve the retirement lifestyle they aspire to.”

Pension Potential has a range of tools including online retirement and lifestyle calculators and an ‘all of market’ annuity search solution to select the best deals. It also gives access to personalised retirement recommendations with a simple ‘advice journey’ which ends with a video call with a financial adviser.