Financial Planning Today editor Kevin O'Donnell recently caught up with Life Planning guru George Kinder, one of the world's best known advocates for Financial Planning, about his new book, his views on the profession in 2022 and how he sees the long-term impact of Covid-19 on the way Financial Planners work.

Financial Planning Today: Hi George, what’s new in the Life Planning world and what’s coming up in 2022? What are the key events and launches you have planned and what do you hope for as we enter a new year?

George Kinder: We've had an incredible 2021! We delivered more programmes, mostly online, to more people than in any prior year, reaching an expanded global audience. We’ve also had more media attention with articles and podcasts about Registered Life Planners and financial life planning than ever before. We are on fire going into 2022 and thrilled to continue the momentum. One of our major shifts during the year will be a focus on educating the consumer market about life planning to drive more clients to financial life planners. I have dozens of conversations for consumers already lined up that will touch on life planning. Our major adviser focus in 2022/2023 will be on developing Kinder Institute's relationship with advisers of all kinds, those who have not taken our programmes as well as strengthening the skills of our Registered Life Planner community with continuing education. We will be looking to expand leadership throughout all the cultures that we're working in, particularly in the UK, to become ambassadors of life planning and meet the needs of their various communities. The final thing that we're really excited about is returning to in-person classes, hopefully by late 2022 and early 2023. Advisers will then have the option of choosing between online and in-person courses based on their personal preference and schedule.

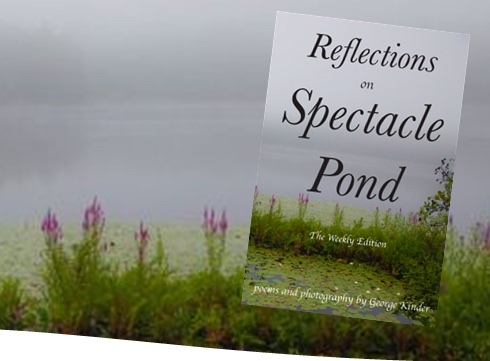

Financial Planning Today: George, you recently published a book of poetry and photography. Can you tell us about this and what the reaction has been. You’ve been sharing some of your poetry online. Have people found this surprising, or inspiring, or a bit of both?

A: Absolutely! Both really inspiring and surprising. I recently launched Reflections on Spectacle Pond, the first of a five-book series of poetry and photography that I’ve compiled over the past 30 years living on the edge of a New England pond. It’s been my life plan. I’m offering the weekly edition free to everyone through an email subscription. Each week of 2022, subscribers will receive a page of poetry and photography along with a reading of the poetry. I am really excited about sharing this work both in the financial community and to the general public with webinars, interviews, podcasts, speeches, slide shows, and poetry readings. What’s wonderful about all of this is I can start each event with the Three Questions and talk about money and meaning. It makes it easy to inspire others to design and deliver their own life plans into the world. Hundreds have already signed up to receive the book at www.georgekinder.com.

Financial Planning Today: Tell us about your own life milestones. Are you planning to retire any day or is that never going to be part of your plans. Do you ever envision a transition to a retired life?

A: I am profoundly engaged with every aspect of my life. I love it, yet I would be foolish not to think about a time when the Kinder Institute of Life Planning would need to go forward with less of my help. It’s one of the reasons that I'm thrilled we are strengthening the skill sets of life planners while building leadership throughout the movement. Though I have no specific plan to retire, I am focused on diminishing responsibility and giving more authority and training ability to leaders within the life planning community, across all cultures around the world. This is especially true for the UK, which is a special place to me, a place Kathy and I hope to spend much of our future as soon as Covid abates, starting hopefully June and July of 2022 and many months in 2023.

Financial Planning Today: You have had a very fulfilled life with a lot of travel and your Institute has grown to become a major influence in the profession. Tell us a little about why and when you set up the Institute in the first place and has it achieved what you wanted? What direction do you see it taking in future?

A: Well, it's been an incredible ride, Kevin. Really a lot of fun. From the very beginning, my thinking was that the whole financial services industry needed to be instead a financial advice profession, a profession that put the clients first. We needed a people-first structure to the industry that put the clients and then their fiduciary advisers ahead of the product companies and all the large institutions. The way to achieve that was to train financial advisers in relationship skills that delivered significant freedom to their clients, delivering clients into their lives of greatest meaning. I think we've created that structure. We've developed a kind of infrastructure that can train advisers all over the world. I'm very excited about that. Where it goes next is building the leadership within those communities and expanding the consumer’s understanding of what life planning is and of the value of it contrasted with the old sales model that we have all been too familiar with.

Financial Planning Today: It’s often said Financial Planners are terrible about taking the advice they give to clients. Do you find this and what advice would you give to Financial Planners about planning their own lives. Should they get other Financial Planners to give them an ‘impartial’ view on their life plan? How can they learn to share their dreams and plans as opposed to just listening to others’ dreams?

A: I don't find that to be the case among Life Planners. I don't know any life planner who has trouble taking the advice they give to their clients. This is because one of the requirements of becoming a Registered Life Planner is to get life planned and to live your life plan. Financial advice just feeds that life plan making it work. Why would anybody not follow that advice if it is going to deliver them into the life that they've longed for and are meant to live?

I would add that if you're having trouble following your own advice, if you're not living your life plan, then absolutely hire a financial life planner to deliver you into the life you feel passionate about. You'll have no problem delivering it into the world. Advisers are kidding themselves if they think they are any good at listening to other people's dreams if they haven't delivered their own.

Financial Planning Today: You’ve often said mindfulness leads to better quality listening. What experiences have led you to this view?

A: I've been meditating for over 50 years and teaching mindfulness meditation for 35 years. One of the things that happens as you practice mindfulness, you get stronger and stronger at letting go of things and not being attached to your own point of view. It’s critical in conversations with clients to not be attached to your own judgments about their lives and their concerns. When a client comes into your office, you're able to be there for them without constantly filtering what they're saying through your own self-preoccupations. So, I've simply experienced that in my own life, with my team at Kinder Institute, with my wife, with my kids, and overwhelmingly from day one with my clients. I noticed that I was able to be there with clients that were coming from a totally different world from mine. I could drop my agendas and just be there for them and celebrate with them what they were excited about. That comes totally from mindfulness. Mindfulness is inner listening. It trains us in listening skills inside ourselves, and then gives us the ability to listen better to others, and to their feelings.

Financial Planning Today: Can people ‘over-plan’ their lives? Do you think too much planning can remove the spontaneous decisions and the ‘gut instinct’ moves in life?

A: Sure, people can over plan. What's important is not so much the planning of a life as living it. Again, that's what happens in life planning. You've planned this incredible life, and all the plan is a thin boundary, it's a set of very simple, often inspiring, rules of how you relate to your world. In life planning you live with passion in that world. If you're over planning, then you're attached too much to the plan itself. In life planning, our emphasis is on delivering people into their lives, not into their plans.

Financial Planning Today: What are your hopes for the Life Planning movement over the next few years. Covid has changed a lot of things but do you think Life Planning and Financial Planning will ever get back to normal? Some have suggested that we will never return to face to face meetings being the norm in Financial Planning - what do you think?

A: My hope for the world is for everyone to live into their dream of freedom. Life planning delivers freedom directly into people's lives. I wish I could live many decades more to see the life planning movement celebrated throughout cultures all over the world because of the freedom it delivers.

Covid has changed things. It's brought many people more urgency about the timeframe of moving into their life plan. It's given many people who have saved more access to their life of freedom. We're seeing more people living their life plans despite the restrictions caused by Covid.

It's just as wonderful to deliver life planning conversations online as it is to deliver in-person. The online meetings will continue, and some people will prefer in-person meetings. We’ve developed a new skill with online meetings that's powerful and useful, and we will not soon abandon it. If we can deliver more life plans to more people further away, we can have clients that are halfway around the world from us and be really connected to them in a moment, well that’s just incredible.