Government figures have revealed “drastic” pensioner income inequality.

The study ‘Income and tax for individuals of pension age, by gender, region and country’ produced figures branded “worrying” by Old Mutual Wealth.

They showed stark differences in pensioner income depending on region and gender.

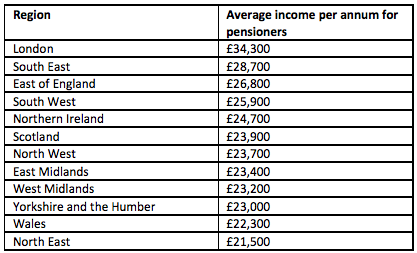

The statistics showed that average pensioner income in London was £34,300, compared to £21,500 in the North East.

Jane Goodland, responsible business director at Old Mutual Wealth, said: “Worrying figures from the Government show that prosperity in retirement differs substantially depending on what part of the UK you are in and what gender you are.

“Pensioners in London have a total income of £34,300 per year to live on, compared to those in the North East who have just £21,500.

“Even if you take into account the difference in living expenses in these two regions, there is still a drastic discrepancy.

“Part of this comes down to how much people are setting aside during their lifetime.

“Research from Old Mutual Wealth shows that 30 to 45 year olds in London save or invest, excluding pension contributions, £351.36 per month, compared to those in the north who save £198.91 per month.

“There are further prosperity gaps when it comes to gender.

“Across the UK women have £6,457 less per year with just £21,966 per year in retirement compared to their male peers who have £28,424.

“With the upcoming generations benefitting from auto-enrolment the regional and gender savings gap may start to narrow.

“In fact figures from the Office for National Statistics shows that across younger generations an equal proportion of men and women are saving into pensions and in fact women are saving more.

“For those aged 25 to 34 years old women with a pension have an average of £14,400 compared to men who have £12,100.”

She added: “However, even with contribution levels rising next month, putting the minimum into pensions will not be enough, particularly as there is still a lack of engagement.

“Auto-enrolment relies on inertia, which while powerful, is no substitute for engagement.

“We need to fundamentally shift the way that people think about saving for their retirement so that it becomes a priority, not an afterthought, but is part of a conscious and considered savings plan.

“An understanding of budgeting, investing and making financial plans can go a long way to boost that engagement.

“The government need to give serious consideration to introducing financial education onto the primary school curriculum in order to tackle the epidemic of financial illiteracy.”