New research from the Association of Investment Companies into the UK Equity Income investment company sector has found that the investments - recently questioned by some - can provide long term value for income-seeking investors in retirement who also want to build up a lump sum to potentially pass on.

The research, based on Morningstar data, looked at long term performance and growth in the investment company Equity Income sector over a 20 year period.

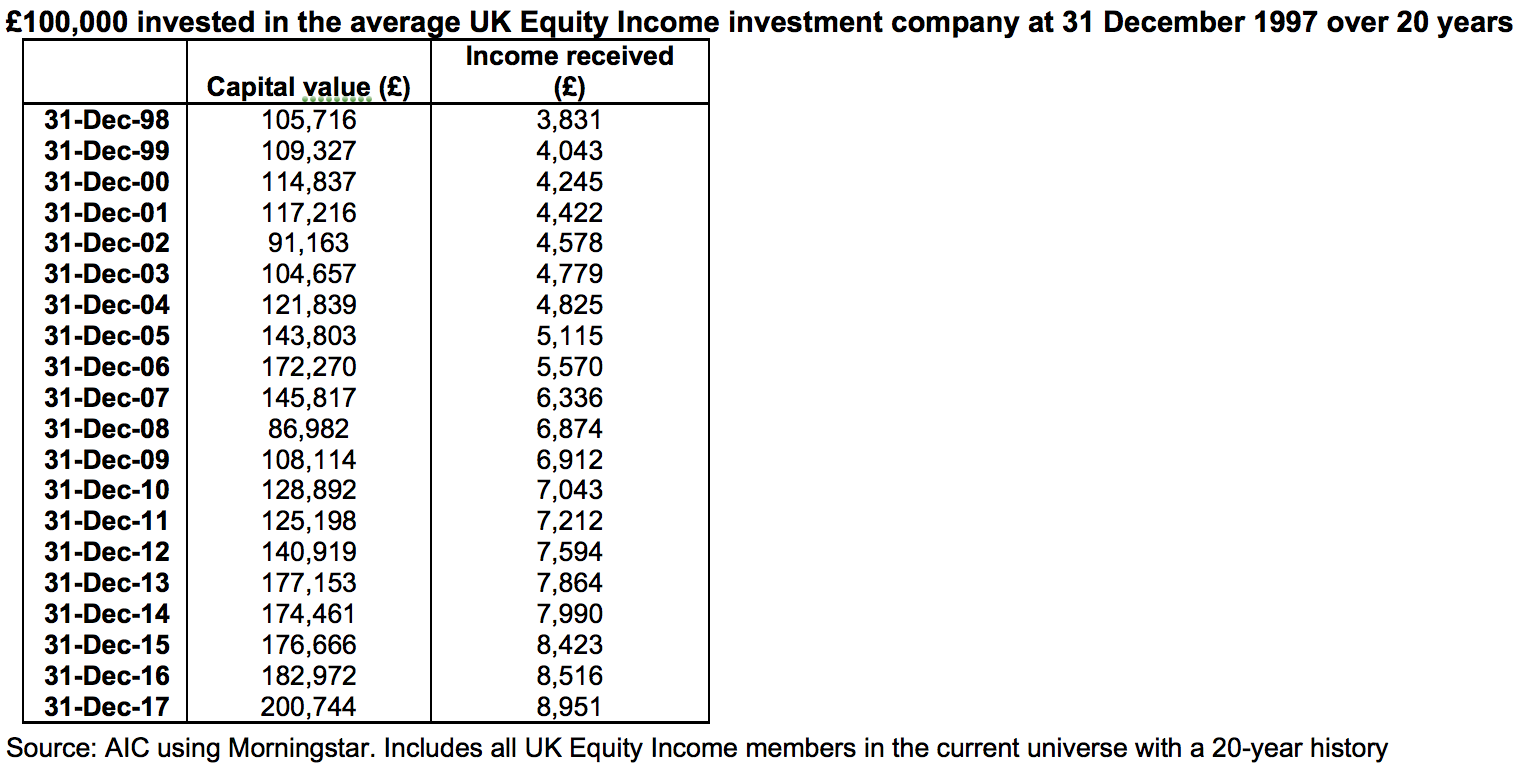

The data shows that £100,000 invested in the average UK Equity Income investment company on 31 December 1997 would have generated an initial income of £3,831 in 1998 and then grown every year to £8,951 in 2017, says the AIC.

Over 20 years to 31 December 2017, the investor would have received a total of £125,122 in dividend payments. Over this period the average annual dividend growth was 4.6%, higher than the annualised RPI inflation figure of 2.8%. Assuming the income generated was taken by the investor, the capital value of the £100,000 investment would have doubled to £200,744, says the AIC.

Annabel Brodie-Smith, AIC communications director, said: “The UK Equity Income investment company sector has not only provided investors with reliable, inflation busting income over 20 years, but also doubled the capital investment after all the income has been taken.”