Independent investment researchers Fitz Partners say the Ongoing Charge Figures (OCF) for typical index trackers have fallen by 27% since 2016.

Pressure from Exchange Traded Funds and other low-cost funds has fuelled the driving down of costs.

The research also debunks the view that ETFs are always cheaper than mutual funds in terms of costs. Fitz reports in its latest research that Global and Emerging Market Index-Tracker funds were up to 38% cheaper than the comparable ETFs.

Research from Fitz Partners Fund Charges database found that index tracker costs have fallen steadily over the past 4 years.

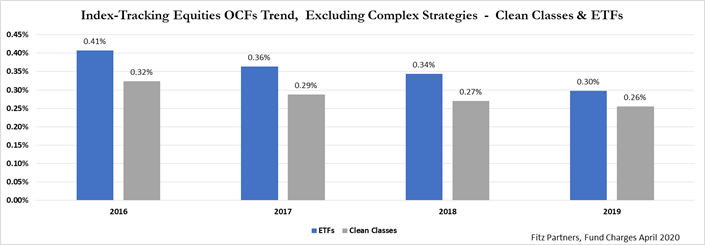

Index tracking equities ETFs Ongoing Charge Figures (OCFs) show a 27% drop since 2016 whilst index tracking equities mutual funds clean classes have reduced by 19% over the same period. Enhanced trackers or complex ETF strategies were excluded from the research.

Source: Fitz Partners

Hugues Gillibert, Fitz Partners chief executive, said: “In our industry, when we describe fee reduction, it is often assumed that active fund products are those under most pressure but our latest fee data show that index trackers have also been following the same trend.

“More interestingly, this drop in fees has occurred independent to whether the passive strategies are offered through ETFs or mutual funds’ clean classes.”

“It is worth noting that, when comparing ETFs and mutual funds fees across Europe, on average, index tracking equities ETFs have remained more expensive than the comparable index tracking equities mutual fund clean share classes.”

Fitz also found that the average OCFs for Europe and US Index Tracking ETFs or mutual funds were remarkably close with their OCFs ranging between 25 and 29bps.

However, for Emerging Market index tracking ETFs and mutual funds clean classes, ETFs products were on average 38% more expensive and for Global tracking products, ETFs were on average 30% more expensive than the corresponding index-tracking clean share classes.

Mr Gillibert said: “ETFs are often considered as a cheaper option to active funds but our research shows that when it comes to comparing passive ETFs against passive mutual funds then the picture becomes more varied.

“In some sectors, when comparing products tracking the same index, ETFs can be a more expensive option but ETFs, as a listed product, can offer advantages to investors such as rapid execution or greater liquidity worth their relative mark-up to some investors.”