The long-term prospects of the retail wealth management industry remain robust despite facing headwinds such as geopolitical uncertainty, rising costs, volatility and a shifting regulatory framework, according to a new study.

Market analyst Fundscape examined the industry's prospects in a new white paper called “The Retail Wealth Management Industry 2025-2029.”

It concluded that the UK retail wealth market, currently valued at £7.1trn, is projected to grow to £9trn by 2029 under a realistic scenario.

The prediction came with a proviso that the growth will not be uniform across all channels and products. Fundsape said the retail platform market and workplace pensions are expected to lead expansion due to strong structural drivers.

It said: “Key growth drivers include the need for self-provision in retirement and the increasing demand for financial advice in the face of regulatory and fiscal complexity.”

The report predicted that the different wealth segments will move at different speeds. It said: “The two constants are investment platforms and workplace pensions, which are bolstered by regulatory and market drivers. Workplace is likely to benefit from the Government’s recently announced initiatives to allow pension schemes to invest more widely and support the UK economy.”

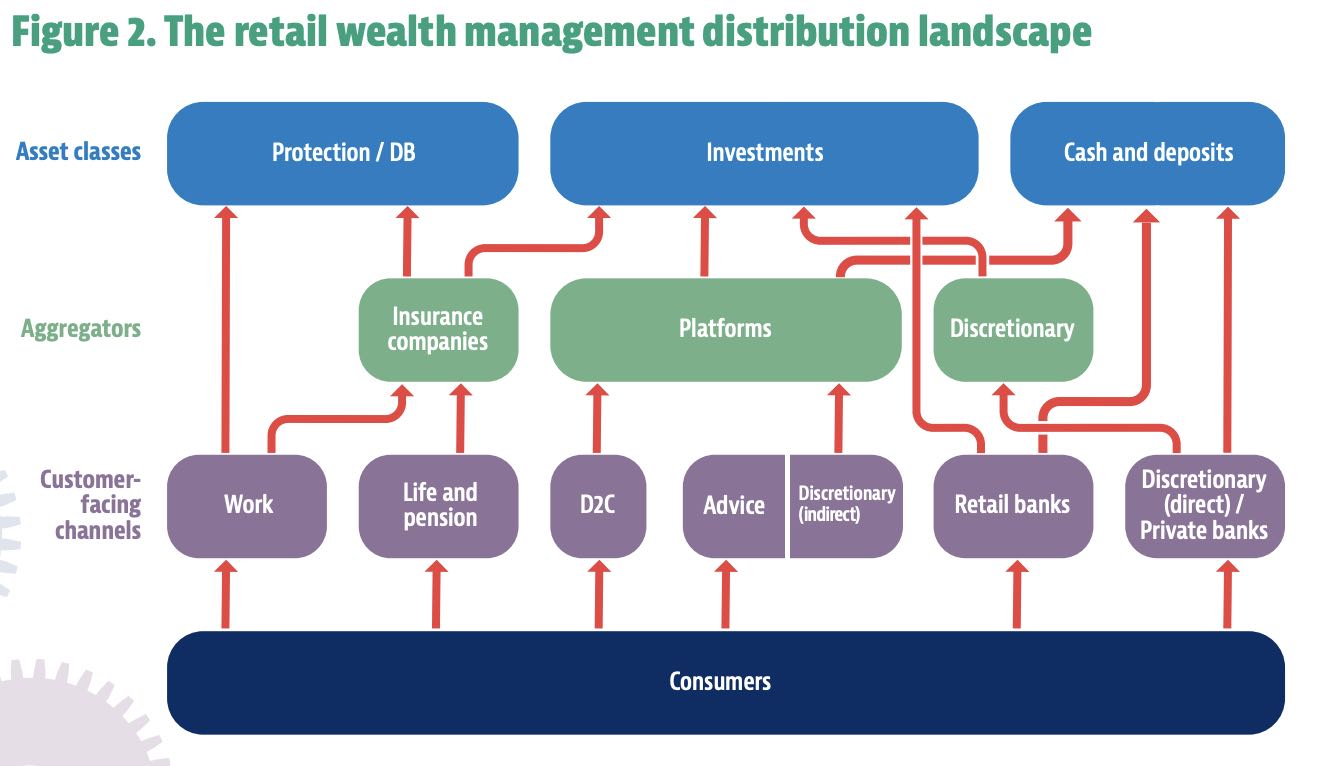

The report looked at the complexities of the UK distribution landscape, with consumers at the base (see image). Platforms occupy the middle, driving the evolution of the UK retail wealth management industry.

The biggest opportunity for the wealth management industry in the future lies in unlocking cash, said Fundscape. It said firms must develop strategies to convert cash ISAs and term deposits into investments. “As an example, some platforms have broadened their propositions and successfully retained clients with cash solutions.”

It added that with the advice gap widening, firms should invest to broaden access to advice and capitalise on the FCA’s advice guidance boundary review and offer technology-enabled advice and hybrid advice solutions.

Fundscape said: “Digital tools should enhance, not replace human interaction. There are huge opportunities for providers to stand out with well-designed, well-trained AI-driven solutions that are seamlessly integrated and offer a guided investment experience.”

The report concluded that “consolidation and vertical integration in the industry are seen as a challenge by many providers. But they also represent significant opportunities to develop solutions or partner with newly-formed consolidated financial services groups.”