Some 40 per cent of people retiring this year still provide financial support to their families, according to Prudential.

In the firm's 'Class of 2013' survey it found retirees provide on average £240 for their families per month with 11 per cent paying more than £500 a month.

The survey questioned over 1,000 people expecting to retire this year.

Around 15 per cent said they helped with items such as food and travel while 14 per cent helped with bigger costs such as holidays and cars.

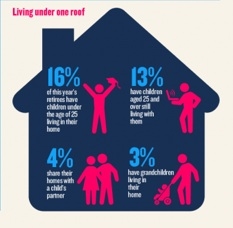

Around two-thirds of retirees say they have no dependents living with them but 16 per cent will still have children under 25 at home, 13 per cent have children over 25 and three per cent will have grandchildren at home.

{desktop}{/desktop}{mobile}{/mobile}

Retirees in London and Wales are most likely to provide this support, with 52 per cent and 49 per cent respectively saying they will support their family financially.

Retirees in the South West region provided the least financial support with only 34 per cent saying they provided financial support to their families.

Regarding inheritance, almost half of retirees expected to have money to leave when they die. However, only 37 per cent said their family expected them to leave one.

Vince Smith-Hughes, retirement expert at Prudential, said: "With nearly half of those expecting to retire this year still providing financial support to their families, retirement income is increasingly becoming a family affair.

"If they can afford the support then there is no issue but with expected retirement incomes at a five year low, any additional outgoings could cause financial strain."

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.