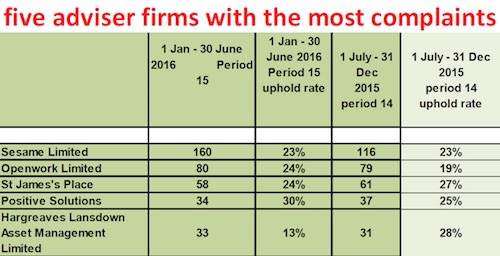

Sesame topped the advice firm complaints league for the first half of the year with twice as many as second placed Openwork.

The Financial Ombudsman Service today report showed that Sesame received 160 complaints, ahead of Openwork with 80, and St James’s Place at 58.

Positive Solutions was fourth with 34, followed by Hargreaves Landsown with 33.

Of the top five, Positive Solutions had the highest uphold rate at 30% - an increase of 5% from the previous half year.

The lowest uphold rate of the five firms by far was Hargreaves Landsown at 13%.

In the life and pensions and decumulation category, Royal London topped the table with 193 complaints, followed by Prudential at 191 and Phoenix Life at 188.

Aviva Life and Pensions UK was fourth at 159 and Friends Life fifth with 151.

However, in terms of the cases in the pensions category, which were resolved in the consumer’s favour, Barclays topped the table with 40% of the cases against it.

Second was Scottish Equitable at 36%, Santander at 36%, and Aviva at 31%, and Friends Life at 31%.

The figures published today show that the ombudsman took on a total of 169,132 new cases across all categories in the first half of 2016 – an increase of 3% on the previous period.

Of the total cases referred to the ombudsman in the first half of 2016, payment protection insurance (PPI) made up 54% of new complaints – with 91,381 new cases (92,667 in the previous period ). For complaints about financial products other than PPI, the number has increased by 8% to 77,751.

One of the reasons for this is payday lending complaints more than doubled when compared to the last six months of 2015.

The average uphold rate (where the ombudsman found in the consumer’s favour) over the six-month period was 48% – ranging from 3% to 92% across the individual businesses. 221 businesses feature in the data in total.

Chief ombudsman Caroline Wayman said: “The data we have published about complaints over the last decade or so helps to illustrates a challenging and volatile period for financial businesses. But the current signs are that complaints are now broadly levelling off and moving onto a more even keel.

“Although it’s a few years now since PPI complaints peaked, we have been receiving over 3,000 a week for six years running - despite wider expectations that numbers will fall. And we’re continuing to deal with the issues and uncertainties around PPI which remain a significant challenge for everyone involved.

“Lots of factors can influence the complaints we see, from more people knowing about their rights when things go wrong to external factors like volatility in the stock market or extreme weather conditions. That’s why I believe it’s important that we continue to share our insights into complaints to help businesses to avoid the mistakes of the past.”