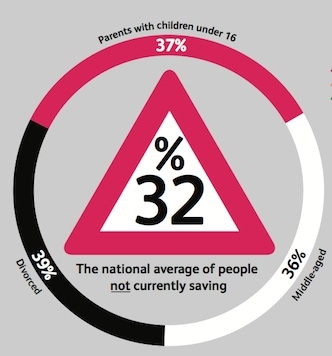

Scottish Widows has identified a ‘risk triangle’ of people failing to save, according to its sixth Savings and Investments report.

The Institute of Financial Planning sponsor questioned over 5,000 people on their attitudes to savings.

It found those aged 35-44, those who were divorced and those with children under 16 were most financially vulnerable.

Some 32 per cent of people are failing to save anything at all, broken down into 39 per cent of divorcees, 37 per cent of people with children under 16 and 36 per cent of people aged 35-44.

Almost a quarter of parents with children with young children revealed they had no savings at all while 28 per cent had less than £2,500.

The failure to save was blamed on having no money available due to household expenses and inflation.

Regarding long-term savings plan, 32 per cent viewed long term as between one to five years while 40 per cent viewed it as between six to ten years.

This creates problems regarding how people plan to save for a retirement fund or young people enrolling in pension schemes.

Those aged 25-44 were urged to think seriously now about how they will provide for retirement later.

Iain McGowan, head of savings and investments at Scottish Widows, said: “We are increasingly seeing people fail to plan properly for the future.

“When a life stage, whether having children, buying a home or planning for retirement, is so far away, we tend not to take it into account, preferring to focus on the here and now instead.

“Not only is this misguided, this short-sightedness will cost the current generation dearly and deliver a huge savings shock further down the line.”