The Institute of Financial Planning sponsor questioned 5,200 adults and found women were saving £776 less than men per year compared to £700 less per year last year.

This means a woman aged 30 who consistently saved at this rate could face a £29,800 shortfall if she retires at 65.

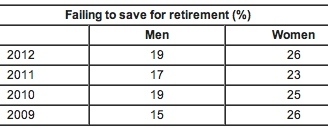

Some 26 per cent of women said they were not saving anything for retirement compared to 19 per cent of men. The amount of women not saving for retirement was back at the same amount it was in 2009, despite slight drops to 25 per cent and 23 per cent in 2010 and 2011.

Some 42 per cent of women prioritised living expenses over pensions with 31 per cent saying they were "saving for a rainy day."

A further 31 per cent of women said they prioritised debt repayments over pensions with the average amount owed, excluding mortgages, being £10,922, up from £10,174 last year.

Lynn Graves, head of business development for corporate pensions at Scottish Widows, said: "Important differences in lifestyle such as being more likely to work part-time or have a full-time caring role, mean women often find it more difficult to save for the long-term and retirement.

"This rainy-day attitude reveals that many women view their savings as a pot to dip into to cover unexpected costs at any time and not as a fund to be ring-fenced and protected for the future to pay for retirement.

"Although there is a clear need to balance everyday living costs with unexpected expenditure shocks, this can't be at the expense of women protecting themselves in old age."

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.