Standard Life has revealed changes to its charging structure for Elevate customers.

The company said it has announced the changes because acknowledged it was “important for us to reassure advisers”.

The move is aimed at helping it become “commercially sustainable” as a “standalone platform”.

Charges for existing customers remain unchanged, the company pledged, adding that costs “could be reduced thanks to the expanding range of discounted fund deals”.

Current customers will be free to move to the new charging structure “if it is beneficial for them to do so”.

Steve Owen, Elevate’s head of proposition, said: “It was important for us to reassure advisers as soon as possible, by removing uncertainty around pricing and supporting their client conversations. Advisers now know their existing clients will not see an increase, and the platform has clear focus and ambition, with a fair pricing model to support this. We can now move forward with confidence in our development plans and strategy for 2017.”

Source: Standard Life

Standard Life made the following promises to customers:

• No existing client will see an increase in their Elevate Portfolio Charge

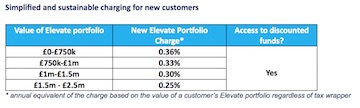

• The number of charging tiers has reduced from seven to four giving advisers and their clients a clearer view of what they have to pay

• On average, for new clients, the Elevate Portfolio Charge will increase 0.04% to allow ongoing investment in the platform developments advisers are asking for

• Further ‘superclean’ fund deals on Elevate mean the total number of discounted funds has increased to 440. Offering an average discount of over 0.10%, advisers can reduce costs for large numbers of both new and existing customers.

David Tiller, Standard Life’s head of adviser and wealth manager propositions, said: “Platform provision is a long-term business so we have ensured the new charging structure is both competitive and sustainable. In making this change, we are also making a commitment to Elevate advisers to deliver the developments they want for their clients.

“It is right that advisers should demand that their platform provider offers the most competitive price possible. It is equally important that advisers feel confident in the commitment of their provider, the stability of the service provided and that investment will be made in the areas that really matter.

“By making the changes announced today, I believe Elevate is a much stronger platform proposition going forward. With a strong and committed owner, investment in development, a sustainable pricing model and access to more discounted funds, I firmly believe Elevate is incredibly well-positioned to help advisers grow their businesses and help more people to benefit from high quality services.”

Elevate said it supports over 2,000 financial advice and wealth management firms in managing SIPPs, ISAs and other investments