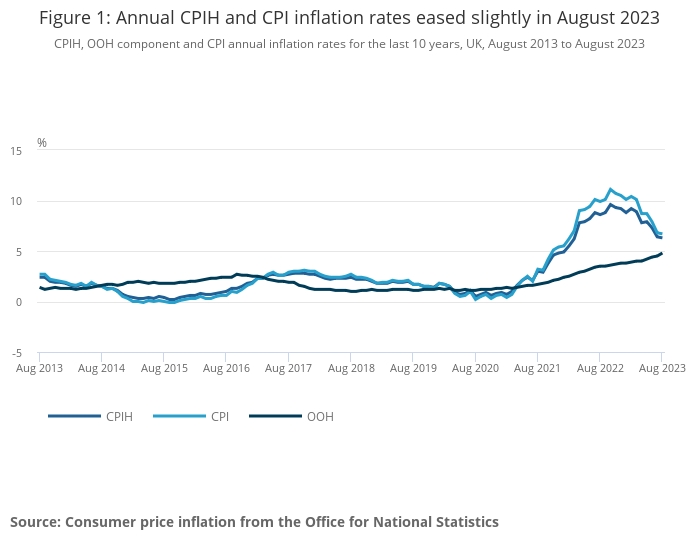

The Consumer Prices Index, the key measure of UK inflation, showed a surprise fall in August to 6.7% from 6.8% in July.

Many commentators were expecting a rise to 7.2% or 7.3%.

The move came despite a sharp recent rise in petrol prices due to a spike in the global price of oil.

On a monthly basis, CPI rose by 0.3% in August 2023, compared with a rise of 0.5% in August 2022, suggesting a downward trend.

The fall in inflation may mean less pressure on the Bank of England to raise the base rate tomorrow from 5.25% to 5.5%.

In the 12 months to August, CPI including owner occupiers' housing costs (CPIH) rose by 6.3% in the 12 months to August 2023, down from 6.4% in July. On a monthly basis, CPIH rose by 0.4% in August 2023, compared with a rise of 0.5% in August 2022.

The ONS said that the largest downward contributions to the monthly change in CPIH and CPI annual rates came from food, where prices rose by less in August 2023 than a year ago. In addition there were falls in accommodation services.

Motor fuel was the largest upward contribution to the change in the annual rates.

Core CPIH (excluding energy, food, alcohol and tobacco) rose by 5.9% in the 12 months to August 2023, down from 6.4% in July. Core CPI (excluding energy, food, alcohol and tobacco) rose by 6.2% in the 12 months to August 2023, down from 6.9% in July.

The older measure of inflation RPI (retail prices index) rose slightly from 9% to 9.1%.

The surprise fall in inflation was greeted as positive news by many experts.

Jonny Black, chief commercial and strategy cfficer at Abrdn Adviser, said: “Falling inflation is good news, but it makes it more important for advisers to explain to clients that this does not mean prices are coming down – it just means they’re increasing more slowly. The Bank of England can’t rest on its laurels just yet as inflation and interest rates remain a complicated balancing act, and eyes are now fixed on tomorrow’s Monetary Policy Committee decision and its impact on people’s finances.

“These are uncertain and challenging times, but that shouldn’t mean considerable changes in client strategies. The support of an adviser will be critical to keeping clients firmly focused on their future goals, and avoiding any steps that could prove damaging in the long-term.”

Susannah Streeter, head of money and markets, Hargreaves Lansdown, said: ‘’It’s a painful and slow path, but inflation is continuing to head down the hill which will ease headaches at the Bank of England. Oil prices did start to march upwards in August, and hit fresh ten month highs this week, but an easing of food and hotel bills have offset the impact of higher prices at the pumps.

“The ramping up of crude prices over recent weeks will filter through, but there will be relief that oil prices have also snuck away from the week’s highs, with Brent Crude falling back to $93 a barrel after topping $95. This fall was partly driven by expectations that the still stubborn nature of inflation will mean central bank policymakers will vote to keep interest rates higher for longer, causing fresh pain for companies and consumers, and push down demand in economies.

Dean Butler, managing director for retail direct at Standard Life, part of Phoenix Group said: “After a tough couple of years of squeezed living standards it’s nice to see some light at the end of the tunnel with inflation now below the rise in average earnings.”