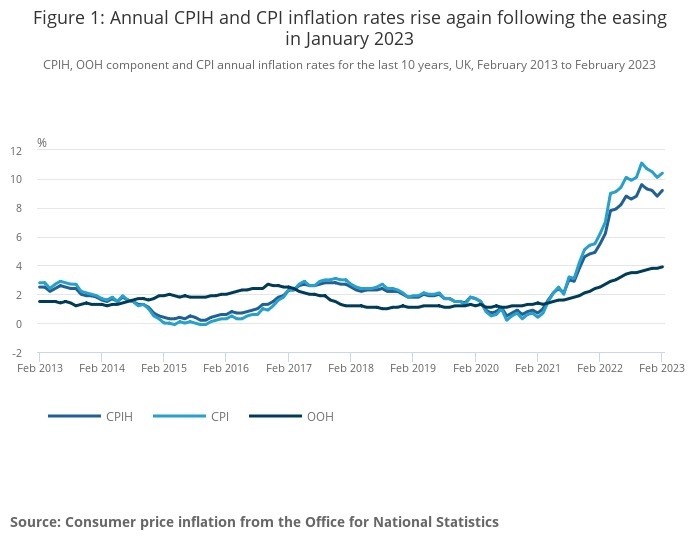

There was a surprise surge in CPI inflation in February to 10.4% - from 10.1% in January - due mainly to rising food prices.

Latest figures from the ONS out today threaten the Chancellor’s Budget prediction that CPI will fall to 2.9% by the end of the year.

The Consumer Prices Index including owner occupier costs (CPIH) also rose by 9.2% in the 12 months to February, up from 8.8% in January.

The biggest upward drivers to the CPIH and CPI rates came from restaurant and cafe prices, food and clothing.

ONS said that the annual inflation rate for restaurants and hotels was 12.1% in February, up from 10.8% in January, and the highest rate since the constructed historical estimate of 12.1% in July 1991. The rate was last higher, at 12.2%, in June 1991.

The upward factors were partially offset by downward contributions from recreational and cultural goods and services (particularly recording media) and motor fuels such as petrol.

On a monthly basis, CPI rose by 1.1% in February 2023, compared with a rise of 0.8% in February 2022. On a monthly basis, CPIH rose by 1.0% in February 2023, compared with a rise of 0.7% in February 2022.

Inflation is now at its highest level since the early 1980s, ONS said.

The 12 month RPI (Retail Prices Index), an older measure of inflation, rose to 13.8% in February from 13.4% in January.

George Lagarias, chief economist at accountancy and Financial Planning firm Mazars, said: “UK inflation surprisingly accelerated. This was mostly due to higher energy and food costs, not discretionary consumption. This confirms our earlier view that the recent OBR year-end 2.9% inflation projections may have been on the optimistic side.

“On the one hand, the number confirms that the economy is not slowing down as much as originally expected. On the other, the CPI figure paints a grim picture for consumers who are facing more difficulties meeting everyday expenses. Inflation above 10% could pull wages higher, increasing costs for businesses.

“Consumer prices remain uncomfortably high, putting additional pressure on the Bank of England which, like other central banks, has to decide between fostering financial stability and persisting on its fight against inflation.”

Sarah Coles, head of personal finance, Hargreaves Lansdown, said: “The surprise rebound in inflation may well convince the Bank of England that it needs to keep raising rates. Not only is overall inflation still in double-figures, and on the rise, but core CPI is also up from 5.8% last month to 6.2%. This may well ring alarm bells at the Bank, which keeps a close eye on this measure,

"We’re still expecting inflation to drop back later this year, especially after April when last year’s energy price hike drops out of the figures, so while this is a surprise, it’s not a horrible shock. The descent was always going to be bumpy, it’s just that this particular bump feels larger and more painful than had been expected."

Richard Ollive, senior financial adviser at the Wesleyan Group, said: "The Bank of England could raise interest rates once more when it meets tomorrow, but savers are unlikely to see the benefit any time soon and there could be even higher costs for those with fixed rate mortgages about to expire and those already on tracker rates."