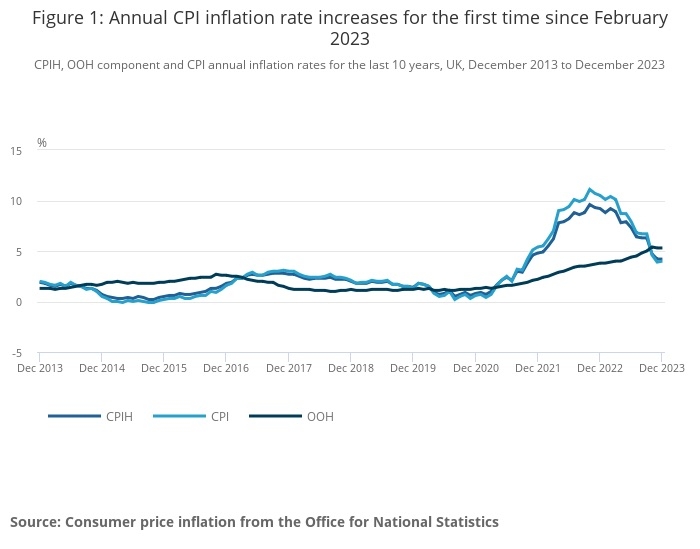

The 12 month rate of CPI inflation increased by a surprise 0.1% in December to 4% despite experts predicting a fall to 3.8%.

Rising alcohol and tobacco prices were the biggest drivers of the increase during the Christmas month.

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 4.2% in the 12 months to December 2023, the same rate as in November.

ONS reported today that on a monthly basis, CPIH rose by 0.4% in December 2023, the same rate as in December 2022.

Inflation has seen a rapid fall from a peak of 11.1% in October 2022. Experts see today’s rise as a blip but warned that expectations of a steady fall in inflation throughout 2024 may be unrealistic and there could be further bumps ahead.

The Consumer Prices Index (CPI) rose to 4% from 3.9% in November. It was the first time the rate has increased since February 2023.

One positive aspect of the latest figures was data showing that the largest downward contribution to CPI came from food and non-alcoholic beverages, news that will provide some relief for hard-pressed grocery shoppers hit by rapidly rising food prices.

The Retail Prices Index, the older measure of inflation, fell from 5.3% in November to 5.2% in December.

Industry experts said the rise was disappointing and underlined economic uncertainty.

Jonny Black, chief commercial & strategy officer at Abrdn Adviser, said: “A climb in inflation isn’t the news that many will have been hoping for. And while we’re expecting inflation to begin to slow throughout 2024, we’re mindful that there are still volatile and uncertain underlying economic conditions at play. There may be some unexpected bumps in the road – periods where clients will particularly value their advisers’ support, counsel and expertise.

“Perhaps the question on most clients’ lips will be what this means for interest rates, and how soon they’ll start to fall. The Bank of England will announce its decision in just over two weeks’ time – another flashpoint where clients will be looking for even closer support, and where advisers have a real opportunity to once again underline their value.”

Danny Vassiliades, partner at XPS Pensions Group, said: “This time last year, CPI inflation stood at 10.5% and the Bank of England was in the middle of 14 consecutive interest rate rises in a bid to control it. Whilst CPI remains above the Bank’s 2% target rate, today’s announcement shows what a difference a year can make."

James McManus, chief investment officer at digital wealth firm Nutmeg, said: “Inflation data in December delivered a surprise on the positive side – with a bigger than expected slowdown in price rises. At the time, we said that halving inflation from 3.9% to the Bank of England’s elusive 2% target was going to be difficult as a result of some of the stickier elements, such as wages, remaining high. Today we’re seeing that struggle play out, with headline inflation coming in at 4.0%."

Simon Kew, head of market engagement at independent wealth consultancy Broadstone, said: “After a significant decline to 3.9% in November, inflation surprisingly edged back upwards again to 4.0% in December.

“It marks the first rise in inflation since February but further falls are anticipated with some economists even predicting inflation to drop below the Bank of England’s target of 2% in the first half of 2024 earlier this week. In spite of the rise in December, inflation is still projected to weaken over the course of the year, stoking predictions of rate cuts despite the Bank of England’s public pushbacks against these market expectations."

Richard Carter, head of fixed interest research at Quilter Cheviot, said: "Though inflation has risen, the latest GDP figure left the UK teetering on the edge of a technical recession and the labour market is showing signs of weakening, so there is no doubt that the Bank of England will continue to face increasing pressure to begin cutting rates. What’s more, the falls in inflation prior to December have also started to take effect on pay, with total pay growth slowing more than expected to 6.5% in November, down from 7.2% in October, which will only exacerbate this further.

“Not only has the headline rate of inflation seen an unwanted uptick, but core CPI (excluding energy, food, alcohol and tobacco) still remains relatively high. Core inflation has been falling much more gradually than the headline figure and now sits at 5.1%, holding steady at the same rate as November. Progress here is likely to be slow, so the Bank may resist making rate cuts until it returns to a more palatable level."