Employers are “sick to the back teeth” of “non-stop tinkering” with pensions, a senior analyst believes.

The Financial Planning sector and businesses is bracing itself for another wave of changes at next month’s Budget.

Hargreaves Lansdown surveyed employers to see what changes they wanted to see.

The top 5 on the wishlist were:

1) Almost 9 out 10 employers (86.28%) want the government to scrap the Annual Allowance Taper - a reduction to the standard £40,000 annual pension contribution allowance, based on an individual’s total income for the tax year. The taper affects incomes between £150,000 and £210,000. The restriction set to affect over 2/3rds of employers.

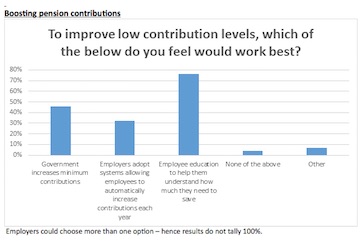

2) 76% of employers favour financial education to boost pension contributions

3) 70% of employers do not think the pension tax relief system should change

4) 41% of employers are considering new reward strategies for their highest earners.

5) 35% feel ‘opting out’ should be abolished

Nathan Long, senior pension analyst at Hargreaves Lansdown, said: “Employers are sick to the back teeth with non-stop tinkering with the pension rule book, the majority simply hoping the Government will opt for a timeout.

“The capping of tax relief for higher earners is causing bedlam for employers.

“Many are having to change whole parts of their reward package to help out just a handful of their most senior staff. Paying higher earners cash in lieu of pension contributions seems popular, but employers are also looking to help staff with their long term savings.

“Financial education, savings instead of a pension and financial advice will play a far more important part in workplace benefits come the new tax year.”