Earnings for both employed and self-employed financial advisers have "increased markedly", according to a census on industry remuneration.

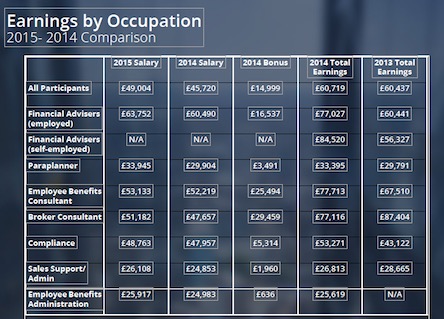

The annual pay packet for an adviser is estimated to be £63,572 in 2015, recruitment firm BWD stated in its report, compared to £60,490 last year.

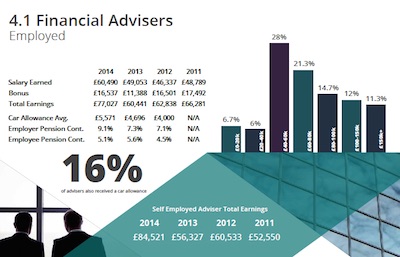

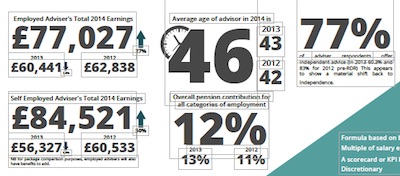

Total earnings for an employed adviser in 2013 were £60,441 on average, while last year this rose to £77,027.

The figures are contained in the BWD 2014-15 census on salaries and benefits in the financial services industry.

A self employed adviser's total earnings jumped significantly higher from 2013 to 2014, rising from £56,327 to £84,520.

{desktop}{/desktop}{mobile}{/mobile}

The authors of the report said that in their first census covering 2012 earnings for advisers were "materially lower" than for either broker consultants or employee benefit consultants and this continued in 2013.

But this trend was altered last year, with the report stating: "In 2014, the situation changed and adviser remuneration – both for employed and self-employed – has increased markedly, so much so that financial advisers are now the highest earning category covered by this census.

"This may be partly attributable to the apparent 'advice gap' where a drop in numbers since the RDR has driven the price of advice upwards – reflected in higher earnings.

"However, adviser earnings have benefited from the business environment in 2014, which continued the good progress made in 2013, with the economy, stock market and housing markets being the main growth drivers.

"Naturally, financial adviser earnings will be more volatile year on year and more strongly linked to business volumes, particularly for self-employed advisers - the highest earning category of all - £84,521 for 2014.

"This is a reversal of the situation in 2013, where employed advisers did better, but as always we need to remember the value of the overall packages enjoyed by employed advisers."

Within the adviser market the DFM sector has "proven to be a major force in generating increased demand for talented individuals", the BWD researchers said.

Salaries and overall packages for advisers have been moving up to reflect this demand, the report stated.

The average age of an adviser has risen again to 46 from 43 in 2013 and 42 in 2012.

The researchers said: "We remain concerned at the lack of younger advisers. The 2013 figures showed just 3% of advisers under 30 – this new Census recorded no advisers at all under 30."