A senior director at The Pensions Regulator has called on pension holders to be more vigilant to combat increasingly "clever and devious" scammers.

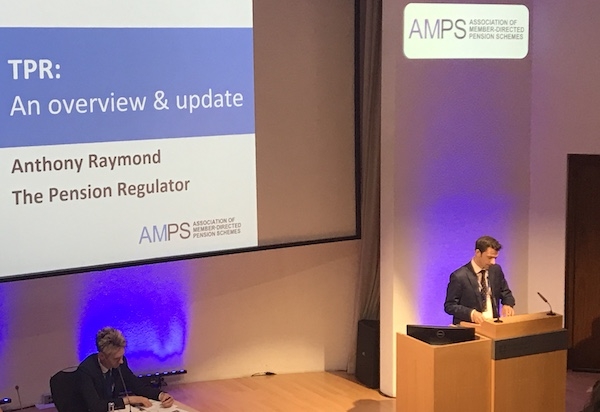

Acting executive director of regulatory policy Anthony Raymond told delegates at the Association of Member-Directed Pension Schemes (AMPS) Annual Conference in London today how the regulator was getting tough on scammers.

He also welcomed a cold-calling ban being introduced by the Government as a means of stopping the “increasingly nefarious” methods used by scammers to prey on the vulnerable.

But he said the key to stopping scammers was to be vigilant.

He said: "There’s no point in sugar-coating it, the damage is done the moment a pension is transferred out of a safe scheme into the unknown.”

He added: “There are some very clever and very devious people waiting to cash in on vulnerable people.”

The message Mr Raymond emphasised throughout the presentation was the TPR’s desire to be “clearer, quicker and tougher.”

Mr Raymond said: “The TPR is constantly accused of being monolithic and slow, but we are a dynamic organisation.”

He highlighted the work of the TPA in bringing four scammers to the High Court, in January, where the were ordered to repay £13m to their victims.

Mr Raymond said the recent focus on data use and misuse had been an ally in combating criminals.

He said: “For us at TPR, working to tackle pensions scams, the heightened public awareness of data is helpful.”

He spoke about the increasing usage of master trusts and how the TPR authorises and de-authorises them. He said that they had increased coverage from 270,000 people to 10m, driven mainly be auto-enrolment.

He said: “They are arguably the biggest change in pensions regulation since auto-enrolment.”

The AMPS conference was opened by chairman Zachary Gallagher, at the Royal College of Physicians in London today.

The event will see presentations on a number of themes from the FSCS principles, Brexit, DB transfers and British Steel to TPR and FCA regulator analysis.

Financial Planning Today will be covering the event live and tweeting about it.

Follow our updates on this website and over on our Twitter pages @FPTodayNews and @FPTodayMagazine