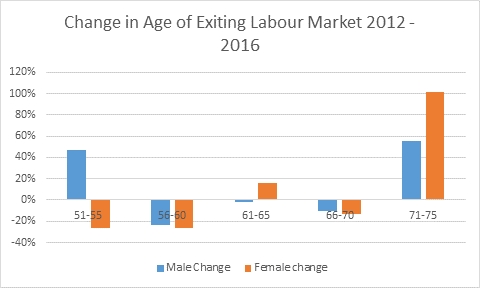

The number of women working after 70 has more than doubled in four years, increasing from 5.6% in 2012 to 11.3% in 2016 and getting close to the number of men working past 70.

Bristol-based investment and advisory firm Hargreaves Lansdown says its analysis of the latest ONS data suggests a rapid recent trend to later life working among women and men.

The analysis found that the number of men leaving the labour market over age 70 jumped by 55% to 15.5% compared to 2012 figures.

HL also noted a surge in the proportion of males aged 51 to 55 leaving the labour market which it attributes to males with high levels of pension wealth taking advantage of pension freedoms to opt for early retirement.

HL says the trend towards later life working needs a more consistent approach by government and employers. It says there needs to be a clear government response, employer adaptations and a change in worker attitudes and action.

Nathan Long, senior pension analyst at Hargreaves Lansdown, said: “Older workers bring valuable skills, experience and loyalty to workforces across the country.

“Ultimately they also need to have the means to leave the workforce and to enjoy retirement when they are ready to do so. This jump in those leaving work over 70 may simply be through individual choice; workers should be encouraged to work as late in life as they are able and feel is desirable.

“However it is also a reflection of the increasing strain on the pension system. The best days of well-funded early retirement are behind us. The risk to employers is of a workforce trapped in jobs they don’t want to do, which will inevitably impact on productivity.

“The Government has already set out their vision for fulfilling working lives, but its success requires employers to embrace flexible working, re-education of employees and the transfer of a lifetime of knowledge. It also relies on people taking individual ownership of their retirement as auto-enrolment alone is simply not enough.’

Change in labour market exit 2012 - 2016

Hargreaves Lansdown wants to see the Government introduce a National Retirement Review at age 50, available through Pension Wise to “kick-start” the retirement savings of many people who only look at their pension plans when it is too late to make any meaningful difference. Age 50 gives people enough time to influence their retirement and later life working plans, says HL.

A Hargreaves Lansdown survey of 700 employers showed 58% expect to see more of their over 50 workers opting to work part-time.