UBS’s wealth management arm has predicted a ‘decade of transformation’ beginning in 2020.

Amid policy uncertainty, core recommendations include quality and dividend-paying stocks, while emerging industry standards should make sustainable investing even more approachable for investors in coming years, the firm says.

UBS Global Wealth Management points to what it called “stark political choices” that make the 2020 outlook more difficult to predict, but it claims “innovation driven by technology and sustainability will present new winners and losers over the decade ahead”.

UBS GWM’s core recommendations for the year ahead are:

• Quality and dividend-paying stocks, as well as domestic and consumer-focused firms that are less exposed to trade and business spending;

• A middle-of-the-road approach to bonds, given very low yields on the safest debt and rising credit risks among high-yield issuers;

• A preference for: precious metals over cyclical commodities; a combination of safe and high-yielding currencies; for low sensitivity to market movements within alternative investments.

Mark Haefele, chief investment officer at UBS Global Wealth Management, said: “Elections, trade tensions and a shifting monetary and fiscal policy mix are likely to define a ‘year of choices’ in 2020.

“However, investors should also look beyond the next 12 months to a ‘decade of transformation’ where new winners and losers could change how investors allocate capital.”

UBS says that over the 2020s, investors will also face a world transformed, with some 790 million people moving to cities.

It says workforces will shrink by 25 million in the developed world and grow by 470 million in the emerging world with the number of internet users rising from 4.3 billion to 7.5 billion.

Sustainability and technology challenges related to these and other factors present opportunities, according to the report.

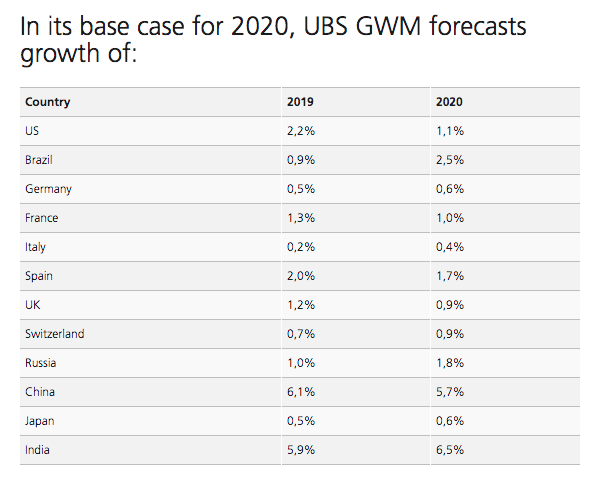

In UBS GWM's base case, the global economy will grow 3% in 2020, down slightly from 3.1% in 2019, according to the report.

Developed market growth will decelerate from 1.6% to 1.1%, while emerging market growth will accelerate from 4.2% to 4.6%.

However, two-way uncertainty was said to be high, driven by choices in geopolitics and policymaking, as well as at the ballot box.

UBS believes the world “will also probably keep a lid on inflation”, with global inflation decreasing from 3% to 2.9%.

The yield on 10-year US Treasuries will decline to 1.8% by the end of 2020, while Brent crude oil prices will decline to USD 60 a barrel, the firm claims.