The latest figures from the ONS day show that the UK avoided recession in the fourth quarter of 2022 but there was zero growth.

The first quarterly estimate of UK real gross domestic product (GDP) showed growth flat in Quarter 4 (Oct to Dec) 2022.

Many experts had predicted the economy would shrink.

The figures support views that the UK may ‘swerve’ a recession, avoiding it narrowly. Despite this the economy remains in the doldrums with inflation high and growth low. Most experts expect a long but shallow recession this year.

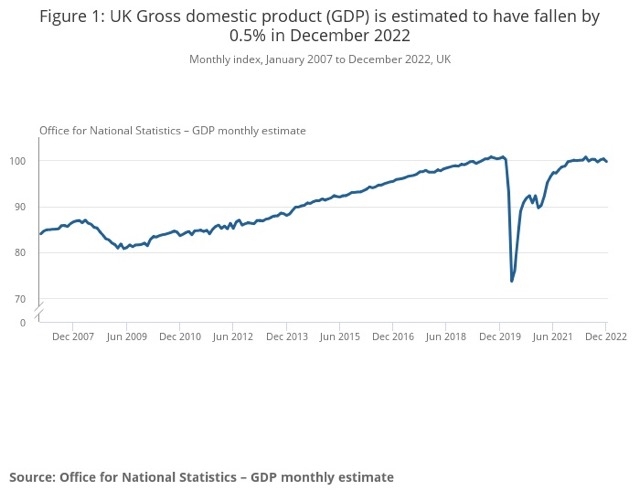

ONS monthly estimates published today show that while quarterly growth was zero, GDP actually fell by 0.5% in the month of December 2022, following unrevised growth of 0.1% in November 2022.

The services sector slowed to flat output in the quarter, driven by falls in the education and transport and storage sub-sectors.

There was growth of 0.3% in construction offset by a 0.2% fall in the production sector in Quarter 4 2022.

Growth in household expenditure in real terms, government expenditure and gross fixed capital formation was offset by a fall in international trade flows in the fourth quarter.

GDP increased by an estimated 4.0% in 2022, following a 7.6% increase in 2021. GDP showed huge volatility during the pandemic.

Despite GDP growth over the past two years, the level of quarterly GDP in Quarter 4 2022 was 0.8% below its pre-Coronavirus (Covid-19) level (Quarter 4 2019).

George Lagarias, chief economist at accountancy and Financial Planning firm Mazars, said: “The flat Q4 GDP comes mostly as a result of poorer consumption as consumption deteriorated. The larger than expected contraction for December means that the trend is negative.

“As time passes, people increasingly dig into their savings and re-mortgage at higher rates. With energy prices remaining high and the government having no fiscal room to help, the cost of living crisis eats more into disposable income with every passing day. Barring a positive unexpected event, the next few months could be some of the most difficult for UK consumers in recent memory.”

Richard Carter, head of fixed interest research at Quilter Cheviot, said: “This morning’s GDP statistics show the UK has narrowly avoided the forecasted recession. While the numbers may appear positive for now, overall the economy is flatlining and it is difficult to see that changing in the short-term. As such, we are still likely to be in a recession at some point during 2023 – which is still expected to be long and shallow - so these figures do not provide a huge amount of comfort.

“The Bank of England may well feel vindicated that the economy is so far surviving interest rates, but the toll on households has still been huge due to rising energy bills and high inflation, while the retail and hospitality sectors have had to deal with significant strike action. These issues are yet to go away, and in reality are likely to hang around for some time yet. As such, it is no surprise to see the IMF predict the UK to be the weakest developed economy in 2023.

“With the spring Budget fast approaching, there is significant pressure on the shoulders of Rishi Sunak and Jeremy Hunt to find ways to stimulate growth.”

Susannah Streeter, head of money and markets, Hargreaves Lansdown, said: "Although a distinct chill descended in December, as bad weather, strikes and more painful price hikes blew in, the downturn wasn’t deep enough to push Britain into recession. There is still a chance the economy will still suffer two back-to-back quarters of negative growth this year, but the murky stretch of water ahead is set to be shallower and less lengthy than predicted in the Autumn when the country was also wracked with financial instability.”