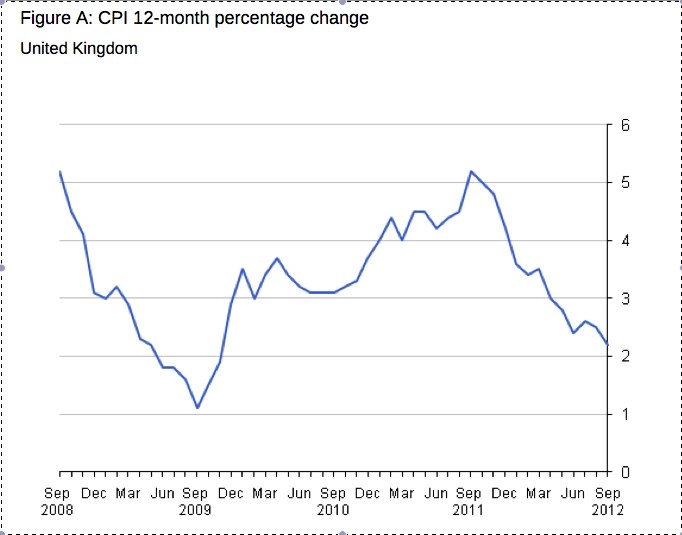

The Office for National Statistics said today that the UK Consumer Prices Index (CPI) annual inflation rate was 2.2 per cent in September 2012, down from 2.5 per cent in August.

The September rate is the slowest rate of inflation since November 2009, when it was 1.9 per cent.

The ONS said that the majority of the downward pressure to the change in the CPI came from the housing and household services sector with September 2011's utility bill rises falling out of the index calculation. However, with recently announced energy rises from some providers the impact of these increases is uncertain.

There were significant upward pressures from the transport (predominantly motor fuels), recreation and culture and miscellaneous goods and services sectors.

The CPI stands at 123.5 in September 2012 based on 2005 = 100. The Retail Prices Index (RPI) annual inflation stands at 2.6 per cent in September 2012, down from 2.9 per cent in August.

ONS says that by far the largest downward pressure to the change in the RPI came as a result of September 2011's utility bill rises falling out of the index calculation. The majority of the upward pressure to the index came from an increase in the price of motor fuels. The RPI stands at 244.2 in September 2012 based on January 1987 = 100.

Since April 2011 the CPI has been used for the indexation of benefits, tax credits and public service pensions.