Seven in 10 investment ISA portfolio are in sectors with top risk ratings of Five to Seven – even though research shows only 9% of UK adults rate their appetites for risk as being this high.

Online platform rplan, which conducted the research, has called for clearer badging of fund risk to help investors make the right choices.

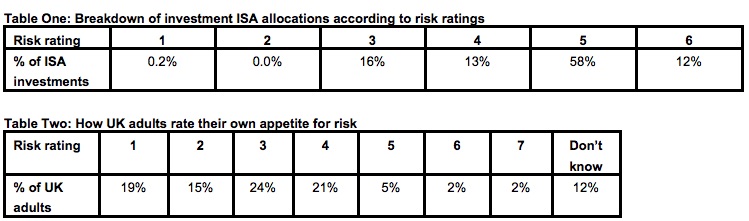

Analysis, conducted by online platform rplan found that on a scale of 1-7 where 7 is the highest, 12% of UK investment ISA assets is held in sectors rated 6 and 58% in sectors rated 5. The analysis also shows 13% is in sectors rated 4 with 16% in 3 and 0.2% in 2 and 1 combined.

While UK adults rate their appetite for risk as 2.56 on average, the risk rating of the nation’s overall ISA portfolio is nearly twice as high at 4.82. Despite this, research among UK adults shows that on a scale of 1-7, 19% rate their own risk appetites as being One; 15% as Two; 24% as Three; 21% as Four; 5% as Five; and only 2% each in Six and Seven.

Nick Curry, director at rplan.co.uk, said: “Many investors in the UK are just not aware of how risky their investments are. Most providers do not display the risk ratings when people are buying funds and even when they are, ratings and other information can be hard to find.

“All fund providers should be displaying the risk levels of their funds clearly, both before and after investing. If necessary, this should be enforced by the regulator.”

Evidence shows that when investors do have risk data their investments more closely align with their stated appetites. For example, the target risk level tool on rplan.co.uk is used by 49% of the platform’s users. Of these investors, 92% are close to their targets in that their portfolio SRRIs are within one level of their requirements, including 60% who are exactly on target.

In a survey of investment platforms commissioned by rplan.co.uk earlier this year, personal finance expert Andrew Hagger of MoneyComms found that only 10 out of 19 of them offered filter tools for investors to match funds to their risk profiles.

Nick Curry added: “There is a danger that mismatches could get even wider as post the Retail Distribution Review, investors with smaller amounts to invest are being spurned by financial advisers and they are undertaking their own investment decisions, many of them with little or no understanding of the risks they are taking. This is especially true of the 3.66m UK investors who like – or are being forced – to construct their own portfolios.”

1,058 UK adults were interviewed by Consumer Intelligence 29 February to 1 March 2016.